New York Online Sports Betting Hopefuls Wait as Budget Deadline Nears

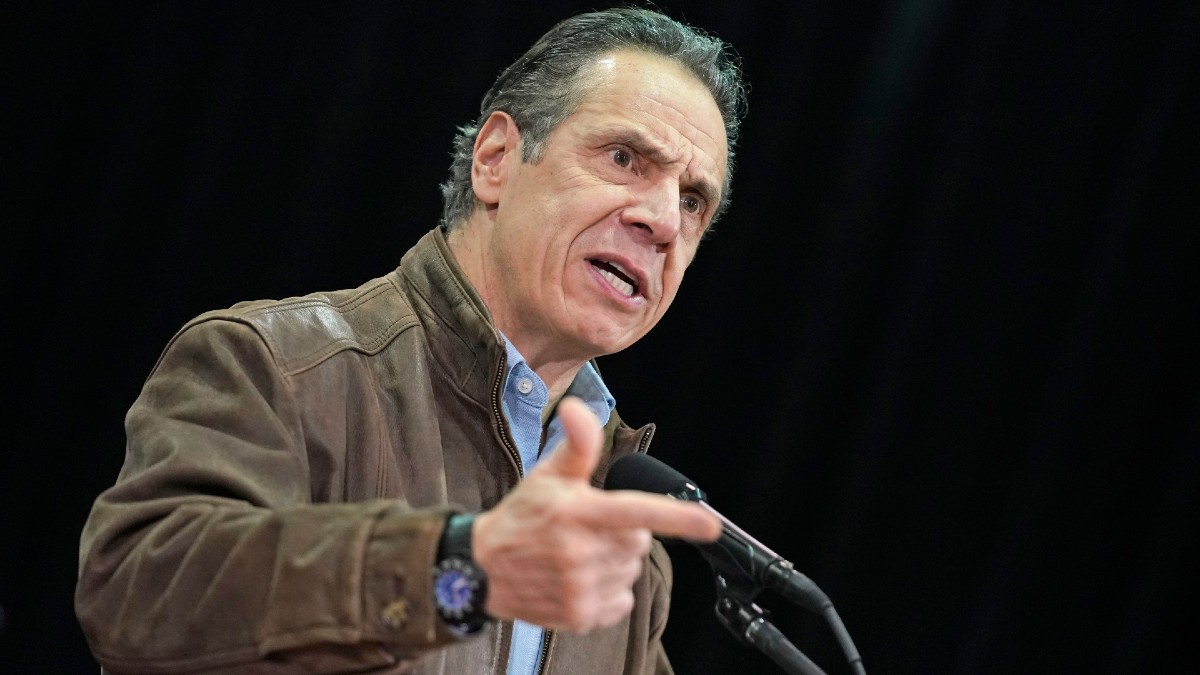

SETH WENIG/POOL/AFP via Getty Images. Pictured: Andrew Cuomo.

New York online sports betting remains in a holding pattern weeks before a crucial deadline that could determine when — or if — the nation's would-be largest market legalizes mobile wagering.

The legislature’s leading sports betting supporters have made little progress since introducing bills in both the Assembly and Senate in January. Lawmakers, sportsbook operators and the industry at large are hoping Gov. Andrew Cuomo's finalized fiscal-year budget clarifies the situation ahead of the April 1 deadline.

“It’s a lot of unknown with the governor’s office. There’s not a lot of details,” Shanna Cassidy, the state Senate gaming committee’s director, said Wednesday at a New York legislative webinar hosted by Albany Law School. “I think at the end of March it’s going to come down to the last minute.”

Governor, Lawmaker Conflict Stalls Sports Betting

Most Democrats in the legislature and governor’s mansion want statewide mobile sports betting. The problem lies between lawmakers’ multi-operator model and Cuomo’s limited-operator proposal.

Cuomo’s unrivaled grip on his state’s Democratic party politics — which in New York is tantamount to full government control — helped thwart mobile sports betting for years. Initially dismissing mobile sports betting as a state budget rounding error and constitutionally untenable, Cuomo upended the gaming world earlier this year when he announced support for mobile wagering.

Facing a projected $15 billion budget shortfall, Cuomo no longer seemed unperturbed by online sports betting’s constitutionality.

Hours later, Cuomo’s single-model operator plan again stunned New York sports betting stakeholders. Expanded in follow-up press statements as “one or more” operators, Cuomo’s limits nevertheless upended lawmakers’ multi-operator plans.

The legislature's plan would allow as many as 14 mobile licenses between the state’s four commercial casinos and three Native American gaming tribes. Certain professional sports venues and off-track betting facilities could also open retail sportsbooks.

Spearheaded by Sen. Joseph Addabbo and Assemblymember J. Gary Pretlow, the multi-operator bills quickly advanced out of the two chambers’ respective gaming committees. Cuomo’s limited-model push has stalled any further progress, leaving New York’s online sports betting hopes in a months-long limbo.

Cuomo’s plan would pit the four commercial casinos’ retail sportsbook partners into a bidding war. The governor’s office has released little further detail on tax rates, operator eligibility, licensing process or much else since his stunning sports betting pivot in January.

Stakeholders Opposition

This plan has frustrated even would-be stakeholders in the meantime.

“The governor's proposal is vague and we'll have to wait and see when, and if, there's a request for proposal to see which commercial casinos will be allowed to offer online wagering,” Stacey Rowland, Rivers Casino & Resort vice president and general counsel, said during Wednesday’s webinar.

“We do not think that it would be fair to create a model that would exclude any of the commercial casinos.”

Under Cuomo’s plan, Rivers and its BetRivers sportsbook would bid against the state’s other commercial retail partners; DraftKings, FanDuel and Bet365. It doesn’t appear the three gaming tribes’ existing retail partners, including Ceasars / William Hill, Stars Group / FOX Bet and Kambi, would be eligible.

Other leading operators such as MGM acquired New York properties partially in hopes it could have a chance to launch its BetMGM sportsbook and online casino in the state. Manhatten-based Barstool Sports and its parent company Penn National have also expressed interest in a potential New York mobile sports betting market.

Cuomo's plan resembles New Hampshire's online sportsbook license bidding process that created a de facto monopoly after Boston-based DraftKings drastically outbid all competitors. This not only excluded customers’ access to all other possible legal sportsbooks, but required DraftKings to offer the nation’s highest tax rate in exchange for exclusive market rights, cutting profits in what is already a low-margin industry.

Gaming attorney Daniel Wallach told Wednesday’s webinar attendees Cuomo’s plan would shred years of work forming a legally and politically amenable sports betting agreement between the various gaming stakeholders.

“To look at New Hampshire as a model for New York just doesn't make sense given the landmass and the population size of New York, and New York's mix of gaming stakeholders of racetracks, casinos, video lottery terminal operators and OTB's (off-track betting facilities)," Wallach said.

Budget Implications

Cuomo said his plan would generate $500 million in annual tax revenues at market maturity. Opponents say the multi-operator model could generate nearly $300 million in licensing fees between the 14 sportsbooks alone, on top of the expanded gross gaming revenues taxes inherent in a competitive market.

Industry observers believe statewide mobile wagering would make New York, the nation’s fourth-most populated state, its highest-grossing sports betting market. Neighboring New Jersey, with fewer than half New York’s population, currently holds that title, taking in roughly $1 billion in monthly wagers — an estimated 20 percent of which comes from New Yorkers.

The federal COVID-19 relief bill Congress passed Wednesday should help alleviate much of New York’s budget shortfall, but lawmakers are still searching for any new revenue opportunities as many New Yorkers — including thousands in the commercial casino industry — are still without jobs. Mobile sports betting could be a fiscally minor, though tangibly important, piece of that budget puzzle.

"(This impacts) real people. That's New Yorkers that have families," Cassidy said while defending lawmakers' sports betting proposals Wednesday. "And just because the governor comes up with this number does not mean that we can't get more revenue for the state.

"We're helping New Yorkers. We're helping them get jobs."

Next Steps

New York elected officials are scrambling to meet a legally mandated April 1 budget deadline. Sports betting backers are hoping Cuomo’s fleshed-out plans will come ahead of the full budget in the coming days.

Even tacit endorsement for a multi-operator model from the governor’s office could quickly push sports betting forward. Otherwise, lawmakers seem unlikely to acquiesce to Cuomo’s limited-operator idea.

In the meantime, several of Cuomo’s fellow Democrats have called for his resignation following his response to COVID-19-related nursing home deaths as well as multiple sexual harassment allegations. Cuomo has said he won’t resign, but it could embolden formerly reticent Democrats who hadn’t opposed the powerful governor’s agenda during his previous decade in office.

Cuomo’s resignation days before the legally-mandated deadline would likely further scramble the complexities around New York’s nearly $200 billion annual budget.

This means New York's 2021 sports betting hopes likely still depend on a solution between two different visions.

“This is a layup for New York state If the governor and the executive branch can maybe find a way to adopt or utilize significant portions of the two legislative bills that are in existence,” Wallach said.

How would you rate this article?