It's a first for the Keystone State.

Pennsylvania has hit a new record in its gambling revenue, reaching a total of $6.4 billion for the fiscal year ending June 2025.

This marks an 8.5% increase compared to the previous year’s revenue of $5.9 billion. The state's continued growth in this sector is noteworthy for several reasons.

For the first time, online gaming (iGaming) has become the largest source of gambling revenue in Pennsylvania, generating $2.48 billion. This represents a significant 27% year-over-year increase. The shift to digital platforms is not just a state trend but reflects a broader national movement towards online gambling.

All of this after coming off a record-breaking month in May. Pennsylvania also became the sixth state to join the Multi-State Internet Gaming Agreement (MSIGA) last April.

Traditional Gaming Categories Remained Flat

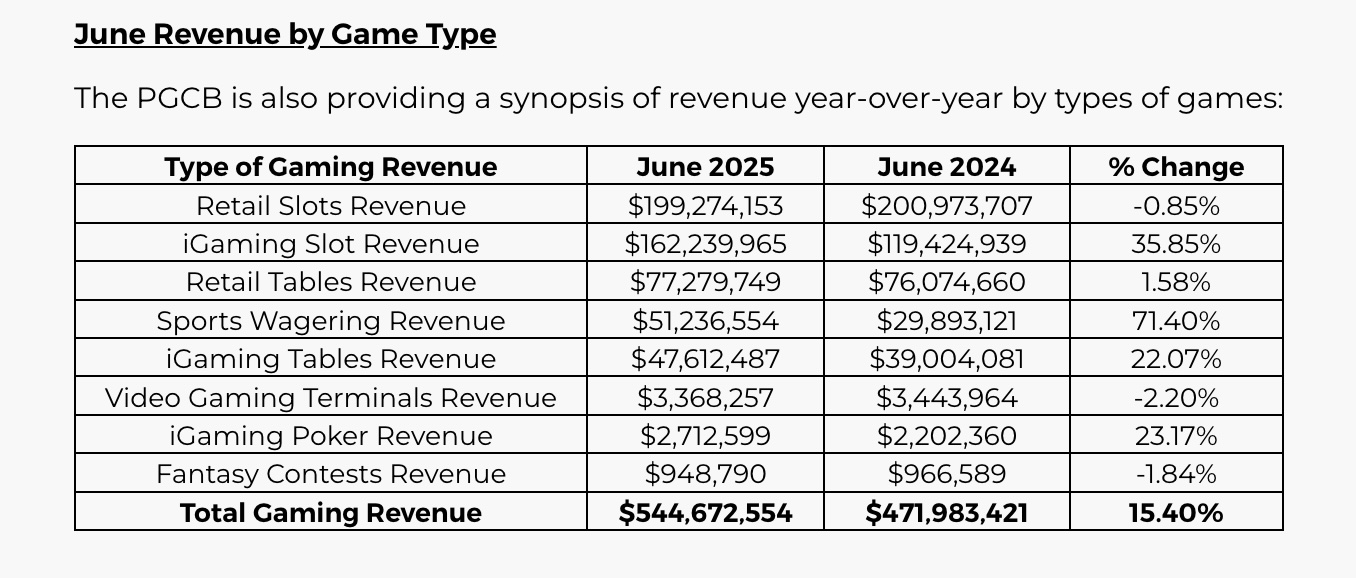

While online gaming surged ahead, revenue from slot machines remained relatively flat at $2.44 billion, showing only a minor increase of 0.1%.

Table games saw a decline of 3.0%, marking the third consecutive year of reduced revenue. Sports betting revenue remained stable at $0.49 billion, despite witnessing a growth in the volume of bets.

Pennsylvania Casinos That Were Leading Contributors

Among the casinos, Hollywood Casino at Penn National Race Course led in iGaming with $935.8 million in revenue. Valley Forge Casino Resort followed closely with $675.2 million, highlighting the growing importance of online gambling platforms.

Tax revenue from gambling also hit a new high, totaling $2.8 billion. This surpasses the previous year’s record of $2.54 billion. iGaming alone contributed $1.10 billion to the tax revenue, showcasing its rapid growth.

Pennsylvania levies high tax rates on gambling, with slot machines taxed up to 54%, and similarly high rates for online gaming and sports betting. These revenues play a crucial role in supporting various state-funded programs, from property tax relief to local economic development.

Shifting Trends, Insights and the Online Surge

The digital shift in consumer preferences is clear, with online casino revenue outpacing traditional slot machines. This change underscores the importance of digital betting options since the legalization of iGaming in Pennsylvania in 2019.

Brick-and-mortar casino revenues are experiencing stagnation. The flat revenue from slots and the decline in table games reflect changing consumer behaviors, increasingly favoring the convenience of online options.

Despite a growing volume of bets, the sports betting market remained flat in terms of taxable revenue. This suggests challenges in converting betting enthusiasm into increased state income.

Economic Impacts of Record Revenues

Enhanced State Finances

The record-breaking gambling revenue of $6.4 billion and $2.8 billion in tax receipts significantly bolster Pennsylvania's fiscal capabilities. This additional revenue contributes to a budget surplus, providing the state with the flexibility to invest in essential public services and infrastructure.

Job Creation and Economic Development

Gambling-related revenues support job creation and private sector investments, contributing to broader economic activity. The stable inflow of gambling tax revenue has bolstered recent private investments and job creation initiatives.

Support for Public Services

Increased tax revenues enable reinforced funding in key areas, such as education, public safety, and infrastructure. These investments can improve the quality of life and further stimulate economic growth across the state.

The Future of Pennsylvania Gambling

With digital platforms continuing to transform the gambling landscape, Pennsylvania has cemented its status as a leading gambling hub, trailing only Nevada in total casino revenue. Regulatory oversight by the Pennsylvania Gaming Control Board ensures integrity and adherence to public interest in this expanding sector.

Pennsylvania's record gambling revenues reflect a dynamic and evolving industry that not only boosts state finances but also supports community investments and economic diversification. As the state navigates these shifts, its balanced growth strategy aims to capitalize on digital trends while sustaining long-term fiscal stability.