As casinos have become an increasingly popular form of entertainment in Virginia, they also serve as substantial contributors to the state's economy.

Last month, the state's three operational casinos—Hard Rock Bristol, Rivers Casino Portsmouth, and Caesars Virginia—continued to make significant impacts.

Not only do these casinos offer gaming experiences for visitors, but they also play a vital role in supporting state programs through their generated revenues and taxes, and September was no different.

In August, Virginia's casinos made 30.4% more, compared to last year. Their earnings went up from $65.1 million in August 2024 to $84.8 million in 2025. They also earned more than they did in July.

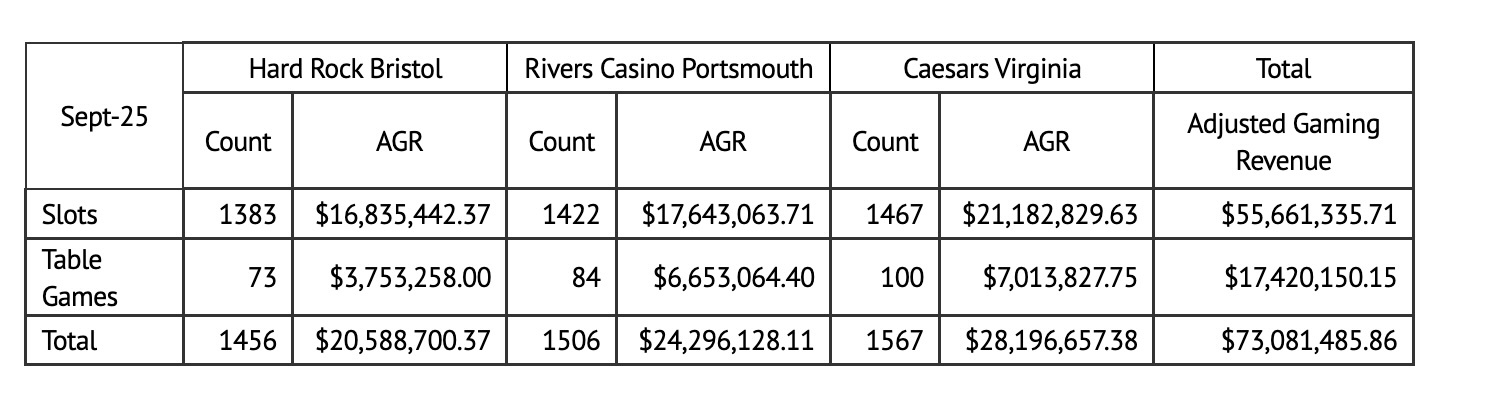

Revenue Breakdown for Casinos in Virginia

Three casinos operate in Virginia: Hard Rock Bristol, Rivers Casino Portsmouth, and Caesars Virginia. In September, these casinos collectively earned $73.1 million in gaming revenue. That's an increase of almost 30% year-over-year.

Here's a breakdown for each:

1. Slots and Table Games:

- Hard Rock Bristol brought in a total of $20.6 million:

- Slots: $16.8 million

- Table Games: $3.8 million

- Rivers Casino Portsmouth earned $24.3 million:

- Slots: $17.6 million

- Table Games: $6.7 million

- Caesars Virginia garnered $28.2 million:

- Slots: $21.2 million

- Table Games: $7.0 million

Caesars Virginia opened its permanent location in December, while the Hard Rock Bristol, opened its permanent location in November. Work also continues on the Petersburg Casino, which broke ground in March.

Overall, Virginia's casinos generated over $55.7 million from slots and about $17.4 million from table games. This occurred despite the pushback against casinos from people in Fairfax County.

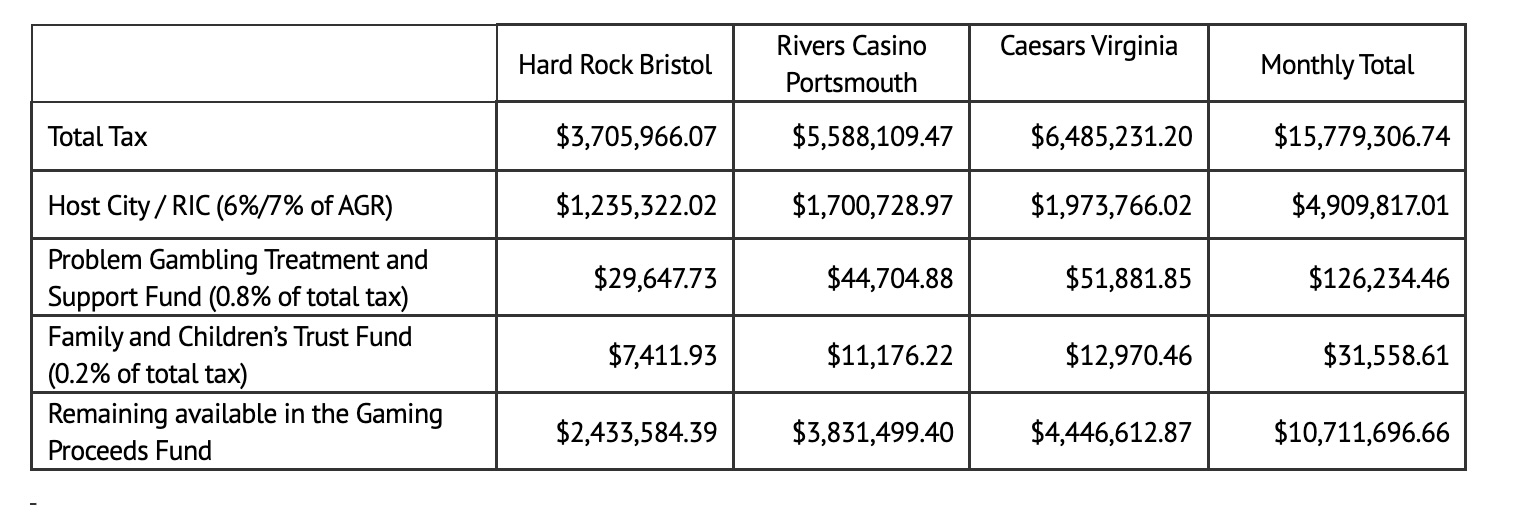

Virginia Casino Taxes and Allocations

Virginia assesses a tax on what is called Adjusted Gaming Revenue (AGR). Of the total amount, nearly $16 million was paid in taxes, contributing to state funds.

The monthly taxes paid by each casino are distributed to a few different funds:

- Hard Rock Bristol paid $3.7 million in taxes.

- Rivers Casino Portsmouth paid $5.6 million.

- Caesars Virginia paid $6.5 million.

These taxes are divided into several specified allocations:

Host City/Regional Improvement Commission:

A portion of the taxes, ranging from 6% to 7% of each casino’s AGR, is given to the host cities or the Regional Improvement Commission for Bristol, totaling $4.9 million.Problem Gambling Treatment and Support Fund:

0.8% of the total tax goes to support problem gambling treatment, totaling $126,234.46.Family and Children’s Trust Fund:

0.2% of the total tax supports family and children’s services, amounting to $31,558.61.Remaining in the Gaming Proceeds Fund:

After allocations, $10.7 million remains available in the Gaming Proceeds Fund.

Each month, these distributions support various community and state programs, ensuring that the casino revenues benefit Virginia's citizens.

Virginia Casinos Continue to Thrive

Virginia's casinos show how entertainment can really help the economy.

The money they make from gaming is used in ways that benefit everyone, like boosting local economies and supporting community programs.

As these casinos grow, they will be expected to help the state in the years to come.