The latest figures are out, and Detroit's casinos presented a mixed bag of revenue last month.

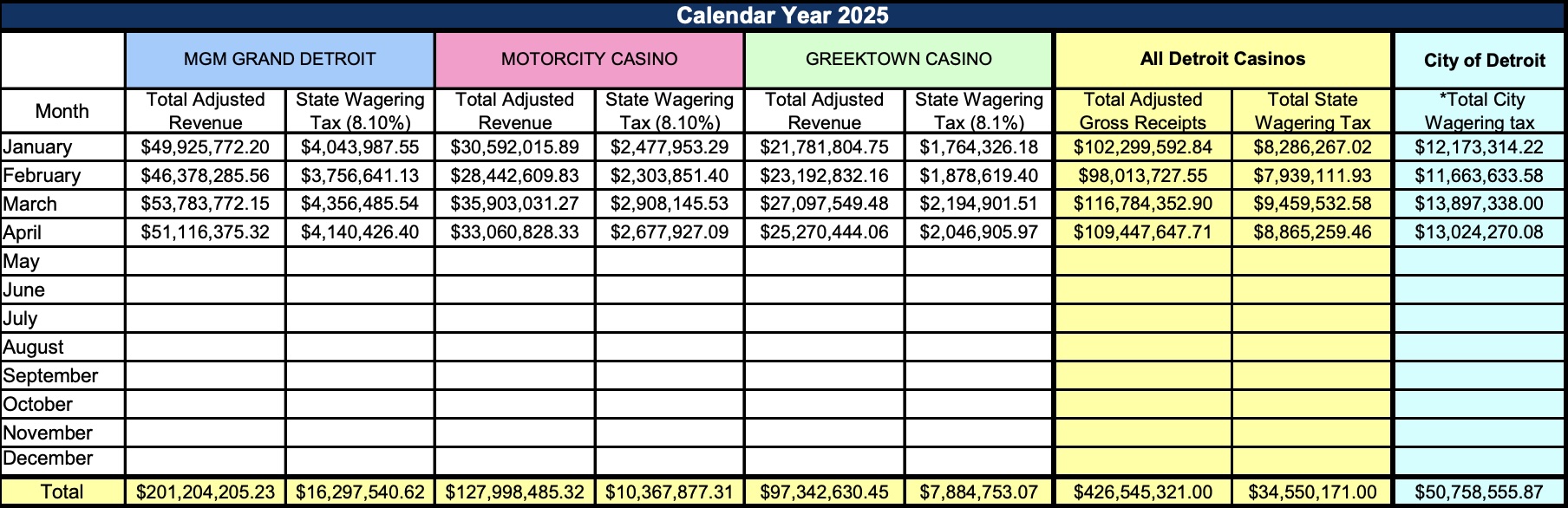

The Motor City's three casinos made a total of $109.8 million in April 2025, according to the Michigan Gaming Control Board. Most of this money came from table games and slot machines, with a smaller amount from retail sports betting.

The news comes after a massive surge in revenue for Michigan casinos in March but amidst a slow start overall for gambling revenue in the Wolverine State.

Let's take a look at which casinos generated the strongest earnings and how this affects the taxes paid to the state and city.

Detroit Casino Market Share Breakdown in April

The market share for each casino in April 2025 was as follows:

- MGM Grand Detroit: 47%

- MotorCity Casino: 30%

- Hollywood Casino at Greektown: 23%

MGM Grand Detroit continues dominating the market, holding nearly half of the market share.

Table Games, Slot Revenue and Taxes

Table games and slot machines collectively generated a significant $109.5 million in revenue. This figure reflects a 1.5% increase from April 2024. However, compared to March 2025, revenue dropped 6.3%. On a year-to-date basis, from January through April, revenue from these games is down 0.5% compared to 2024.

For April 2025, the revenue changes for each casino relative to April 2024 were:

- MGM Grand Detroit: Up 2.5%, totaling $51.1 million.

- MotorCity Casino: Up 1.2%, totaling $33.1 million.

- Hollywood Casino at Greektown: Down 0.2%, totaling $25.3 million.

In terms of contributions to the state and city, the three casinos paid a total of $8.9 million in state gaming taxes, an increment from $8.7 million in the previous year. Additionally, $13.0 million was submitted in wagering taxes and development agreement payments to the City of Detroit.

Retail Sports Betting Revenue and Taxes

Retail sports betting in April 2025 reported a total handle of $9.4 million, yielding gross receipts of $336,021.

The qualified adjusted gross receipts (QAGR) from sports betting have dropped significantly, declining by 79.8% compared to April 2024 and down 44.6% from March 2025.

Here’s the QAGR performance for each casino in April 2025:

- MGM Grand Detroit: Negative ($219,857)

- MotorCity Casino: $223,859

- Hollywood Casino at Greektown: $312,536

Despite these challenges in retail sports betting, the casinos paid the city $20,276 in state gaming taxes and $24,781 in wagering taxes.

Fantasy Contests Contribute Strong Showing

Although not directly related to the casino revenues, fantasy contest operators added to the gaming ecosystem with a reported total adjusted revenue of $634,191 for March 2025, contributing $53,272 in taxes.

So, while table games, like blackjack, and slot revenues showed resilience, retail sports betting struggled to reach previous levels. Both state and city governments continued to receive substantial tax contributions, ensuring continued financial support from the gaming industry in Detroit.