Las Vegas revenue figures continue to be somewhat volatile.

Nevada's casinos faced a slight dip in gaming revenue last month, compared to the previous year, according to the Nevada Gaming Control Board.

While some areas bucked the downward trend with revenue gains, the Las Vegas Strip experienced its third consecutive monthly decline. Maybe the start of the World Series of Poker and the opening of the newly renovated pool at The Flamingo will help to buck the trend.

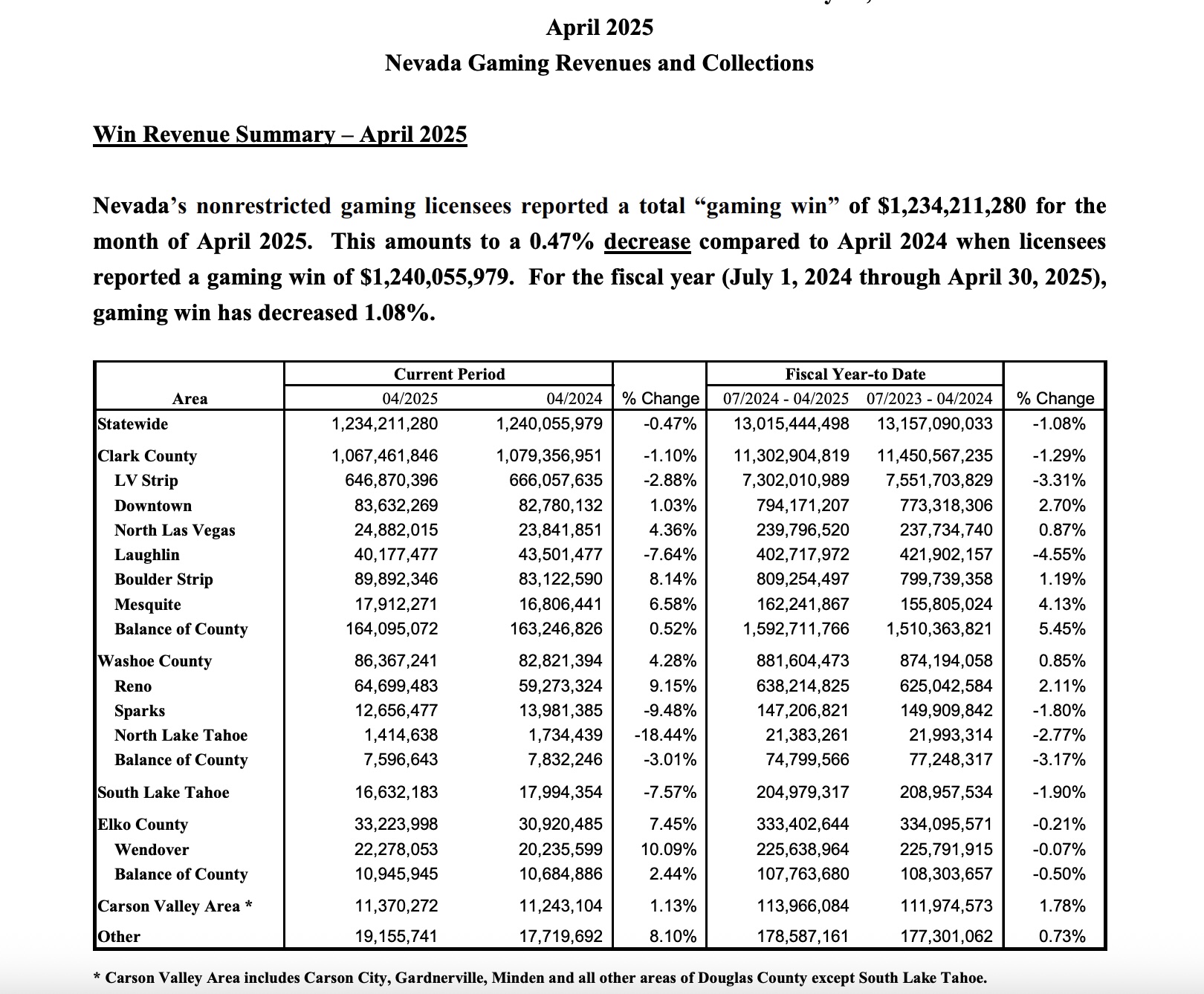

Statewide Gaming Revenue Insights

Nevada's total gaming win in April reached $1.23 billion, reflecting a modest decrease of 0.5% from April 2024. This chart provides a breakdown of the revenue figures from year to year.

The Las Vegas Strip, a key player in the state's gaming economy, saw its revenue drop by nearly 3% to almost $647 million compared to the same month last year. It comes on the heels of a 4.7% decline in March and a 13.7% decrease in February.

This third month of decline on the Strip contrasts with gains observed in areas like Downtown Las Vegas, North Las Vegas, and other regions such as the Boulder Strip, Washoe County, Elko County, and Carson Valley.

Differing Trends in Gaming Types

Baccarat brought in more money on the Las Vegas Strip this April compared to last year.

Revenue jumped by 42%, reaching about $108 million, up from $77 million in April 2024. The amount of money wagered increased by nearly 17%, and casinos kept 15% of the wagers, which is higher than the 12% they kept a year ago.

Slot machines revenue totaled about $883 million, reflecting a slight decrease of 0.5% compared to the same month last year. Revenue from table games also went down by 0.5%, totaling around $352 million.

One bright spot in all of this is mobile sports betting. It surged by more than 35%, reaching more than $33 million. Basketball emerged as a significant contributor to this growth, generating nearly $21 million, which marks an increase of almost 52%.

Baseball and ice hockey produced an additional $12 million and $5 million of gaming win for April 2025.

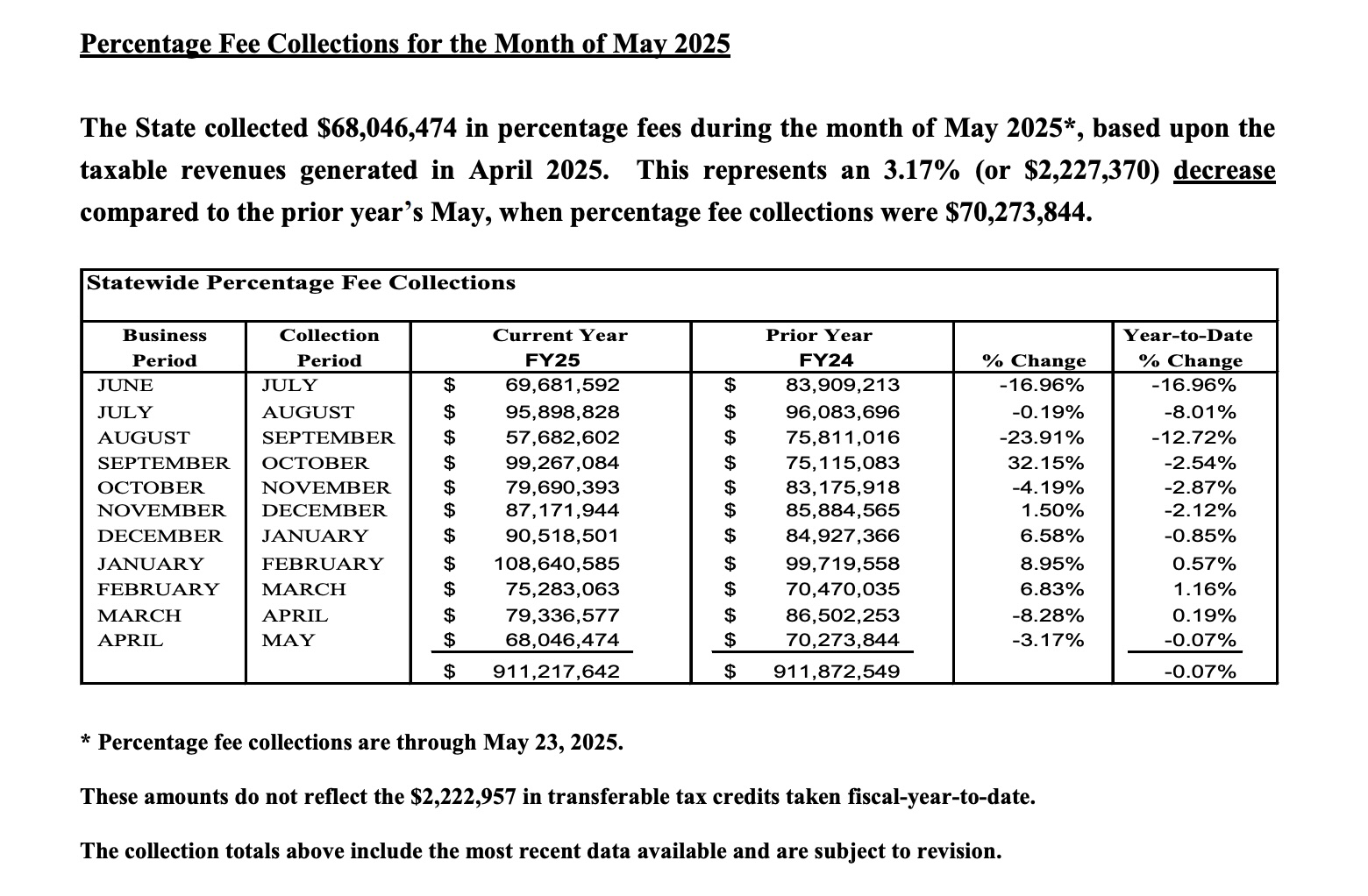

Collection of Taxes and Fees Also Affected

In light of these figures, Nevada collected $68 million in percentage fees in April 2025. This represents a 3.2% decrease from April of the previous year, following a larger decline noted in March.

Factors Influencing the Revenue Drop

Several factors appear to have contributed to the observed revenue decline. The Las Vegas Convention and Visitors Authority (LVCVA) reported a 5.1% drop in April visitation, impacting tourism-related revenue.

In the first quarter of 2025, Las Vegas also saw some declines in hotel performance. According to Kevin Bagger from the LVCVA, visitor numbers dropped by about 7% to 9.7 million compared to the same period last year. Convention attendance also decreased by 2% to 1.8 million.

The average daily hotel room rate fell by 8% to approximately $189 per night, and hotel occupancy was slightly down by about 1 percentage point, landing at 82%. Passenger traffic at Harry Reid Airport also dropped by around 4% in March, marking the second month in a row of declining numbers.

April 2024 also benefited from major events like Super Bowl LVIII and an extra day of play because it was a leap year, making current comparisons challenging.

Some also think that property disruptions like the closure of the Tropicana and ongoing renovations at The Mirage removed available hotel rooms, further influencing visitation and spending.

As the numbers reveal, April 2025 was a mixed month for Nevada's gaming industry. While some regions showed resilience, key factors like reduced tourism and lack of major events noticeably impacted the revenue. Moving forward, the industry will be keenly watching these trends to strategize for the coming months.