Massachusetts casinos continue to put up big numbers month-to-month, and sports betting in The Bay State is also going strong.

The Massachusetts Gaming Commission recently released the September revenue figures for the state's casinos and sports wagering operations.

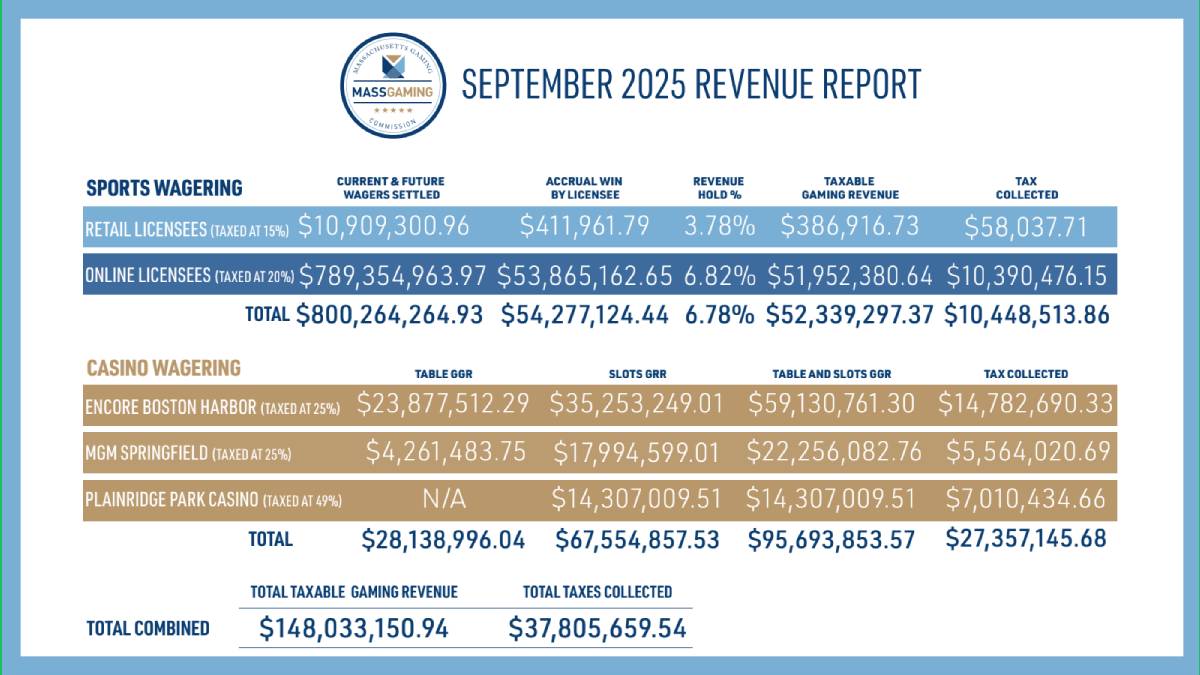

Overall, the state's three casinos — Plainridge Park Casino (PPC) in Plainville, MGM Springfield in Springfield, and Encore Boston Harbor (EBH) in Everett — generated nearly $96 million in Gross Gaming Revenue (GGR) in September.

This is an increase of nearly 4% compared to September 2024’s $92.1 million, indicating a healthy growth trend in the Massachusetts casino market.

Meanwhile, Massachusetts lawmakers are still considering a move to legalize online casinos.

Which Massachusetts Casinos Performed Best?

Across all Massachusetts casinos, slots revenue increased by 7.5% year-over-year to $67.6 million. However, table games experienced a slight decline, dropping 3.7% to $28.1 million.

Here's a breakdown of the revenue each casino in Massachusetts generated in September.

- Plainridge Park Casino (PPC): Specializing in slots, PPC earned over $14 million, marking a 9% year-over-year increase, the highest percentage among the three casinos.

Encore Boston Harbor (EBH): EBH saw its total revenue top $59 million, which is a 2.5% increase from the previous year. While slots revenue jumped by a little more than 8%, climbing over the $35 million mark, table game revenue saw a slight decrease of almost 5%, settling at just under $24 million.

MGM Springfield: This casino reported a little more than $22 million in total revenue, reflecting an increase above 6% from September 2024. Slots revenue increased by more than 7% to $18 million, and table games grew modestly by 2.5% to a little more than $4 million.

Since casinos started operating in Massachusetts, the state has collected around $2.218 billion in taxes from these activities.

Massachusetts Sports Wagering Revenue Highlights

In addition to casino revenue, sports wagering has become a substantial contributor to the state’s gaming industry.

In September, sports wagering revenue reached approximately $52.34 million, coming from both mobile/online platforms and in-person venues.

Taxation and Allocation

The collected revenue does not just sit idle; it is allocated to various state funds:

Casino Gaming Tax: PPC is taxed at 49%, while MGM Springfield and EBH are taxed at 25%. The taxes collected are channeled into local aid, the Race Horse Development Fund, and other state-specific funds.

Sports Wagering Tax: Tax rates for sports wagering vary; in-person operators are taxed at 15%, whereas mobile/online operators face a 20% rate. The revenue is distributed among several state initiatives, including the General Fund, the Workforce Investment Trust Fund, and more.

For sports betting, which began in 2023, the state has gathered about $339.15 million in taxes from both in-person and online betting.

Encore Boston Harbor, MGM Springfield, and Plainridge Park Casino can run in-person sports betting at their locations because they are licensed as Category 1 Sports Wagering Operators. They pay a 15% tax on the money they make from this.

Companies like Bally Bet, BetMGM, Caesars Sportsbook, DraftKings, ESPNBet, Fanatics Betting & Gaming, and FanDuel are Category 3 Sports Wagering Operators. This means they are allowed to offer sports betting through mobile apps or online, and they pay a 20% tax on their earnings.

The tax money collected from all sports betting operators is divided in this way: 45% goes to the General Fund for state expenses, 17.5% to the Workforce Investment Trust Fund, 27.5% to the Gaming Local Aid Fund for community benefits, 1% to help youth programs, and 9% to the Public Health Trust Fund.

Massachusetts Casino and Sports Betting Numbers Expected to Stay High

The ongoing rise in casino and sports betting money in Massachusetts shows that the gaming industry is doing well.

As this growth continues, it means good news for the state because the money from these activities helps pay for various public services and state programs.

Whether you follow the gaming industry or are just interested in where the state's money comes from, it's clear that gaming plays a big role in supporting the Massachusetts economy.