Talk about turning the tables. 1.1

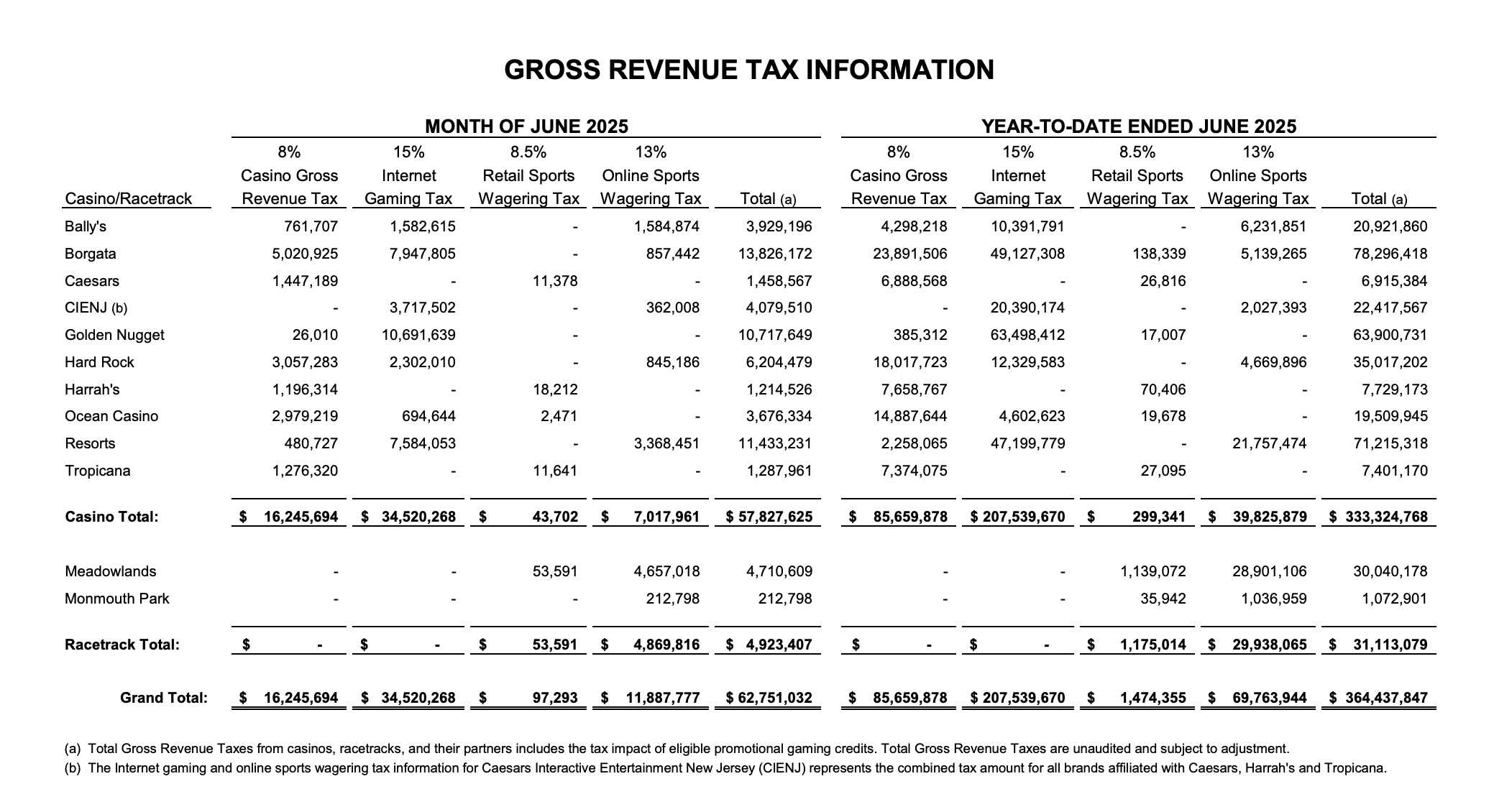

After ending a four-month streak of generating less revenue than online casinos, New Jersey's traditional casinos are now on a two-month winning streak, according to the New Jersey Division of Gaming Enforcement's (DGE) most recent report.

The Garden State's gaming landscape saw brick-and-mortar casinos surpassing their online counterparts in revenue in June, continuing a trend that started in May.

This shift highlights the robust performance of Atlantic City's physical casino sector despite ongoing growth in the digital gaming space. This also comes as the state prepares to ban sweepstakes casinos altogether.

Brick-and-Mortar Casinos Lead the Charge

Land-based casinos reported a revenue of $259 million in June 2025, which represents a 6.1% increase from the previous year.

This growth is noteworthy given that there was one less Saturday this June compared to last year.

The income from these physical establishments is a significant driver for the economy of Atlantic City, providing a strong backbone for the local economy during the bustling summer months.

iGaming Shows Robust Growth, Yet Trails Behind

While brick-and-mortar casinos have been leading, internet gaming showed impressive growth with a revenue of $230.7 million in June 2025.

This figure reflects a substantial 23.5% increase from June 2024. Despite this rapid growth, online revenues still trailed behind the more traditional casinos' earnings.

New Jersey Casino Trends in Recent Months

Here are some of the trends that have developed in New Jersey that are related to traditional and online casinos:

- January-April 2025: Showed lower revenues across both sectors, in line with the seasonal trends, as summer months typically boost casino activity.

- May 2025: Stood out as the peak month for both brick-and-mortar and online gaming, setting high benchmarks for the year.

- Sports Wagering: Remains the smallest sector in the gaming industry and saw a decline from May to June.

State lawmakers also increased their gambling tax rate for online casinos and sports betting to 19.75%. This change was finalized on June 30 as part of the FY26 state budget and took effect starting July 1.

Before this hike, the tax rate was 15% for online casinos and 13% for sports betting. The new rate applies to both online casino and sports wagering revenue, reflecting a significant increase intended to raise additional revenue for the state

A Strong Year for New Jersey's Gaming Industry

Overall, New Jersey's gaming industry is experiencing a noteworthy year, with both physical and online sectors performing at or near historic highs despite a slight dip in total revenue from May to June.

The sustained success of land-based casinos indicates strong consumer interest in the traditional gaming experience, even as the digital sector rapidly expands.

As we move further into 2025, the gaming industry in New Jersey stands resilient, with brick-and-mortar casinos proving themselves key players in the state’s economy. This summer surge underscores both the popularity and economic significance of traditional casinos amid the digital era of gaming.

We'll watch to see how the rest of the year plays out.