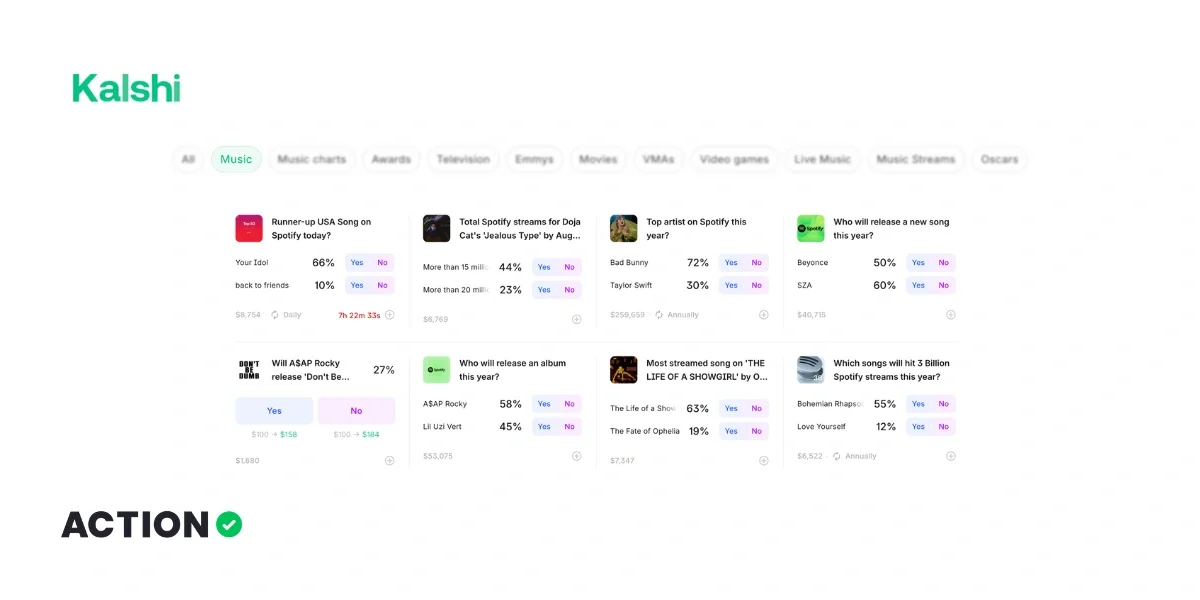

Besides being the world’s biggest music streaming service, Spotify's become a scoreboard. On regulated exchanges like Kalshi, users now can trade on how songs and artists will perform on Spotify’s official charts. These top song prediction markets let traders put money behind questions that fans debate every day, like Will a track cross one billion streams this year? Which single will top the global chart? Who ends 2025 as the most-streamed artist?

On Kalshi, these markets are live today under CFTC oversight, and outcomes are tied to Spotify’s published web charts, not playlists or in-app rankings. That makes the trading less about vibes and more about measurable data and analysis made by listeners who actually know how this stuff works.

You can learn more about Kalshi and the Kalshi Referral Code by checking out our review!

How Spotify Top Song Prediction Markets Work

Prediction markets function like exchanges. So instead of betting slips, you’re buying event contracts linked to yes/no outcomes. For instance, if you believe a song will reach a milestone (say, one billion streams before year-end) you can purchase a “Yes” contract. If that happens, the contract settles at $1. If not, it expires at $0.

But who decides and measures the price of the contract? Market probability. If “Yes” is trading at $0.70, that implies a 70% chance the event occurs. Buy at $0.70 and win, and you pocket $0.30 per share.

All of this is driven by participants placing orders. Market makers quote prices to keep activity flowing, while market takers step in and hit those prices when they want immediate action. Just like in sports or financial trading, managing exposure matters: no artist is guaranteed to hold the top spot all year, not even Taylor Swift.

Event-Related Contracts Explained

Spotify-related contracts always boil down to a binary result:

- Will a specific song reach 1 billion streams this year?

- Will Taylor or Bad Bunny finish as Spotify’s global top artist?

- Will a new release open at No. 1 on Spotify’s chart the week it drops?

Each “Yes” contract that resolves true pays $1. Each “No” settles at zero.

Why Are Prediction Markets Important for Spotify?

Streaming data basically turned music into something fans can track daily. Now, prediction markets take it one step further, letting traders express opinions about popularity in real time. These contracts act more like financial products than casual bets, with prices shifting as new information, like a viral TikTok song or a surprise album release like "The Life Of A Showgirl", hits the market.

Betting on the Top Global Song on Spotify

Among all the Spotify prediction markets, the year-end Top Global Song contract usually draws the most attention. It’s the one question traders and fans rally around: Which track will finish as the most-streamed song worldwide by December 31?

This market tends to be one of the busiest because it blends everyday listening habits with broader cultural moments. How come? When a new album drops, a collaboration surprises fans, or a track catches fire internationally, the prices of contract adjust almost instantly. That constant movement is what makes it a focal point for traders who follow Spotify charts week after week.

The Decision Tree: Which Factors Make Hit Songs

However, markets don’t move on name recognition alone. Traders and listeners usually run through their own version of a decision tree, weighing the most likely to push a track into year-end contention:

- Artist firepower: Global names like Drake or Bad Bunny can rack up tens of millions of streams overnight. That early surge often sets the tone.

- Playlist placement: Landing on Spotify’s biggest editorial playlists can swing numbers dramatically, and contracts usually react as soon as a track gets added.

- Longevity: It’s not just about debut week. Songs that stay in heavy rotation for months keep accumulating streams and remain in the mix.

- Cultural hooks: Sometimes outside moments (from a stadium chant to a movie soundtrack) give a track the extra push it needs to climb.

For example, did you know that in December 2023, the film Saltburn featured Sophie Ellis‑Bextor’s classic “Murder on the Dancefloor” in its final scene, and that made the song re‑enter Spotify’s charts and rack up its highest-ever global streaming day on New Year’s Eve 2023? Crazy.

Markets shift as these things change, and traders watch each branch of the “tree” closely to predict which songs have staying power and which are short-lived spikes.

Read more - Rotten Tomatoes Kalshi Predictions

Who Will Release a New Song/Album This Year?

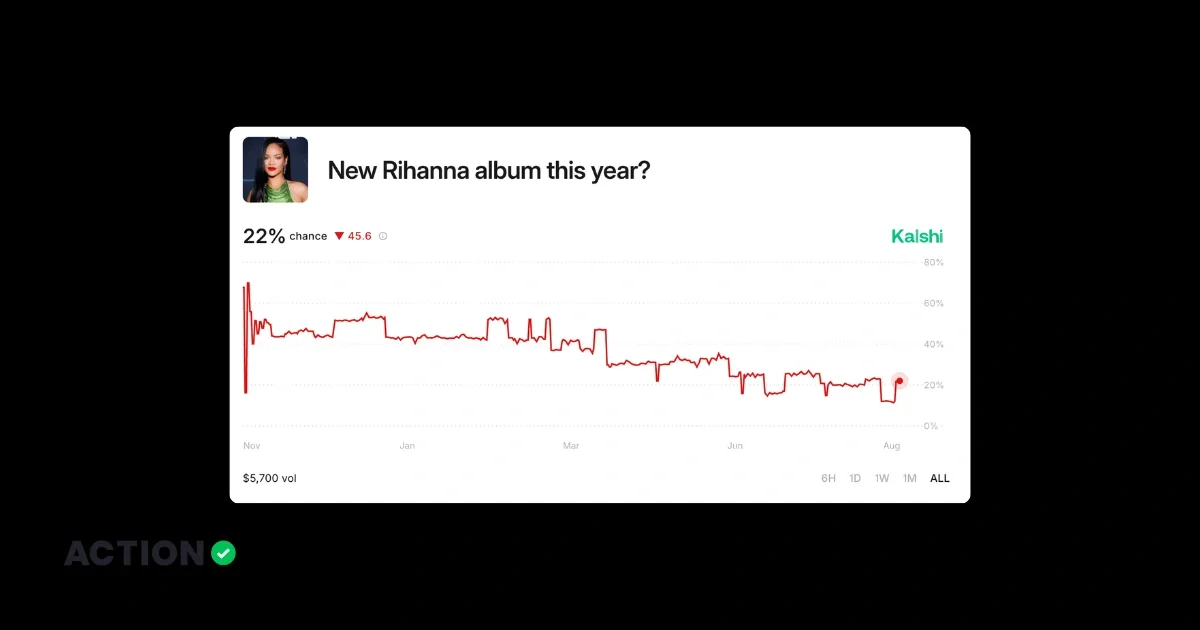

Not every Spotify prediction market tracks streams. Some contracts simply ask whether a major artist will release new music before December 31. These are speculative by nature: months of silence can flip in an instant when a single is announced.

And because labels keep release plans under wraps, these contracts often swing on rumors, leaks, or a single social media post. They’re harder to predict, which is exactly why traders follow them.

Big Names in The Music Industry

Artists that make an impact on those markets usually are the ones that have uncertain timelines but huge amounts of followers:

- Rihanna: Even a hint of a comeback moves prices.

- Kendrick Lamar: Long breaks between projects make a confirmed drop worth watching.

- Adele: Rare output, but guaranteed attention when it happens.

- Frank Ocean: Okay, this might be just us wishing for it, but he's still one of the most speculated-about names, so every hint matters.

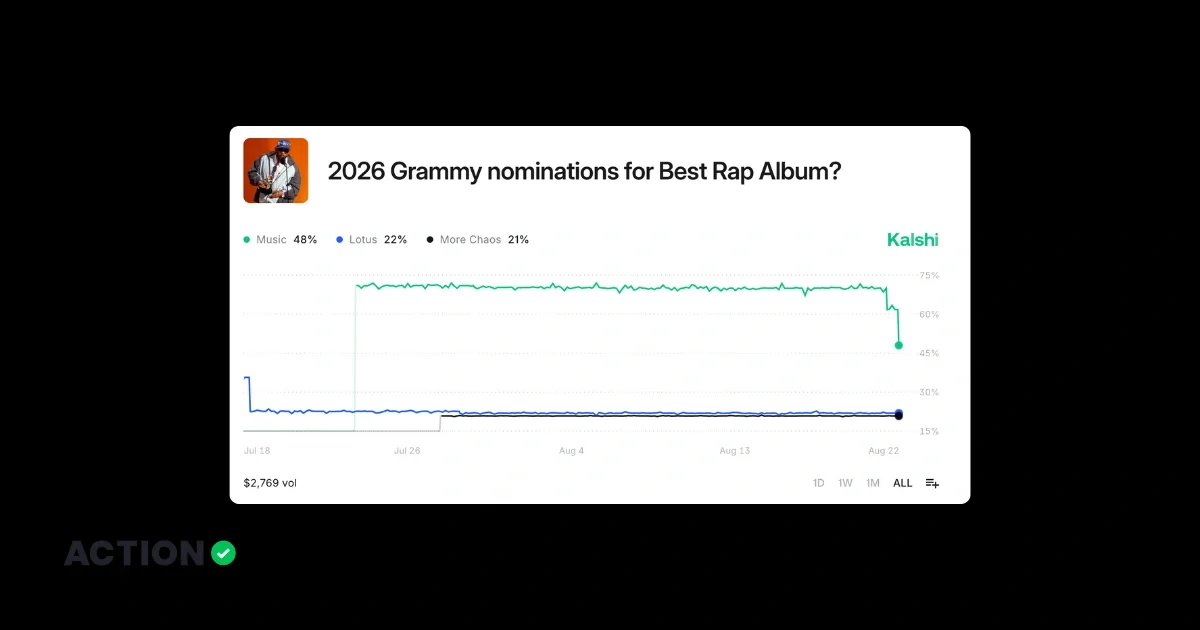

Which Songs Will Hit 1 Billion Streams?

The billion-stream milestone is still one of the most active prediction markets. And while more songs cross it every year, the methods that get them there vary and predicting which ones actually get there still takes analysis and skill.

- International reach: Tracks that cross language or regional barriers move fastest.

- Playlist placement: Major lists can add millions of plays weekly.

- Longevity: Songs that remain in rotation keep piling up listens.

Take Flowers by Miley Cyrus: in 2024 it hit a billion in record time thanks to all three factors, meaning traders saw those odds rise quickly as daily data confirmed the pace.

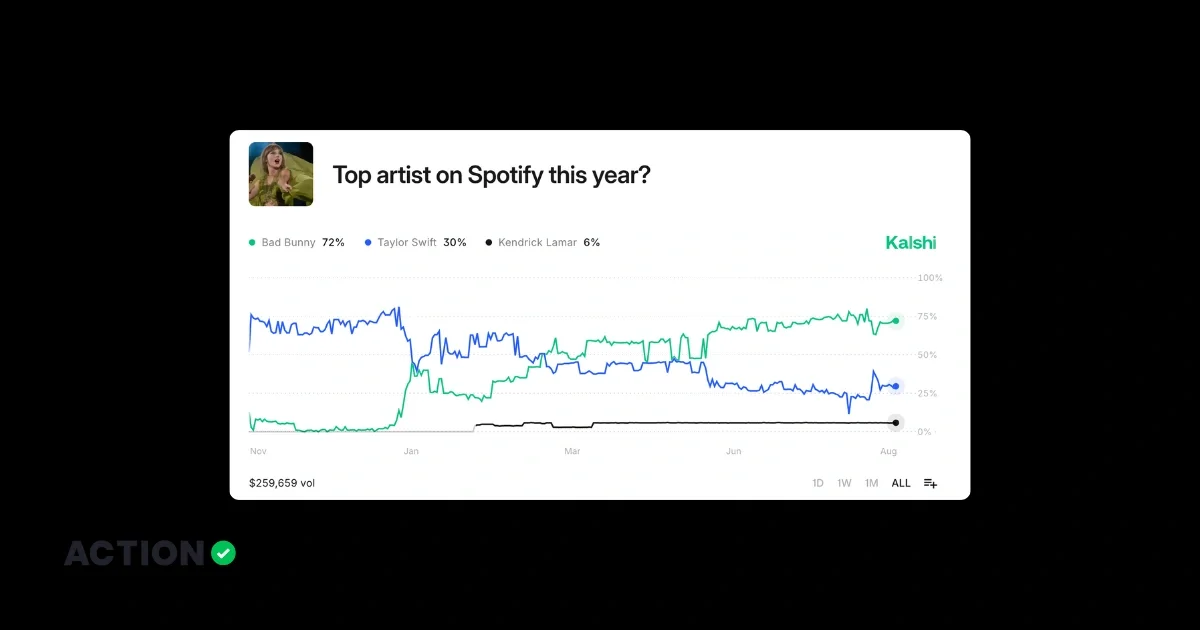

Top Artist on Spotify This Year

If the “top song” market spotlights one track, the top artist contract covers an entire catalog. The outcome? Who finishes the year as Spotify’s most-streamed artist.

For this type of bet we have to mention again the one and only, Taylor Swift. At this point, leaving her out of the conversation would feel like ignoring half the market There's also Bad Bunny, as he already owns three straight years at No. 1. And who knows, there’s even been speculation about the two releasing a track together, which would instantly make predictions explode. Until then, this market stays wide open.

At the end of the day, ending the year as Spotify’s top artist isn’t just about bragging rights. It shapes touring demand, brand partnerships, and the way the industry allocates resources. For prediction markets, that combination of popularity and financial impact makes this one of the most liquid categories. And for traders themselves, it’s one of the cleanest ways to predict where the music business is heading.

Latest Prediction Odds

Check out some of the recent Spotify Predictions, by February 2026.

| Spotify Prediction | Option 1 | Option 2 |

| Top Song on Spotify U.S this year? | APT.: 1% (Yes/No) | DtMF: 6% (Yes/No) |

| Top artist on Spotify this year? | Taylor Swift: 31% (Yes/No) | Chappell Roan: 3% (Yes/No) |

| Top album on Spotify this year? | The Life of a Showgirl: 9%(Yes/No) | Short n' Sweet: 3% (Yes/No) |

Understanding Contract Prices, Odds, and Payouts

To trade effectively in Spotify prediction markets, you have to know how contract prices map to probabilities. It’s the same math traders use everywhere else, just applied to streams instead of point spreads.

- How it works: If “Yes” trades at $0.60, that reflects about a 60% chance of the outcome. Buy at that price and win, and you profit $0.40 per share. If you entered at $0.20 and it hits, the payout jumps to $0.80.

- Why it matters: For traders, this is the analysis step, so not just tracking songs, but measuring risk and reward before entering the order book.

Risk management here isn’t about bankrolls the way it is in sportsbooks. It’s about deciding how much exposure you want in each market and recognizing that even the most popular artists can stall.

Read more - Grand Theft Auto 6 Kalshi Predictions

The Future of Prediction Markets For Music

Music streaming platforms have become one of the clearest measures of global music popularity. And with contracts tied directly to that data, prediction markets now give traders a new way to predict cultural shifts.

A few things to watch as this project grows:

- Liquidity expanding: More traders mean deeper pools and tighter spreads. That creates more realistic pricing for both casual bettors and professional traders.

- Different methods of forecasting: Some participants lean on raw streaming data, while others look for predictors like playlist additions or spikes in social chatter. Groups of listeners effectively act like their own crowd-sourced models.

In short, these markets show how hit songs can be tracked, priced, and even predicted with tools that look more like financial instruments than fan polls.

The energy around predicting hit songs is only growing, and as more artists perform globally and new genres break through, prices for contracts will move in ways that show that cultural momentum. For traders, that constant buying/selling is what keeps the market alive.

They’re contracts tied to Spotify’s official charts. Traders buy and sell positions on outcomes like which track becomes the most-streamed song or which artist ends the year on top.

Billboard blends radio, sales, and streams. The music streaming platform's prediction markets settle only on Spotify’s published data, which makes them narrower but easier to measure.

Yep. If your prediction is wrong, contracts expire at $0. That’s why traders lean on risk management and analysis instead of hunches alone.

Absolutely. Viral hits or songs boosted by playlist placement can put first-timers into the same conversation as established stars. That unpredictability is part of what makes predicting hit songs so active and fun.