Taylor Swift prediction markets on Kalshi are Yes/No event contracts tied to outcomes you can verify later, charts, announcements, NFL attendance, and yes, the Travis Kelce rumor cycle. Prices run from 1¢ to 99¢ and the price implies probability. The punchline is right there in the data: one Swift contract shows $1,616,729 in volume while “Yes” is sitting at 2¢. Tons of attention, a very opinionated crowd, and a rulebook waiting at the end to settle it.

Want the full breakdown of how Kalshi works, fees, and eligibility? You can learn more about Kalshi and the Kalshi Referral Code by checking out our review.

TL;DR

- You trade Yes/No event contracts, not point spreads.

- 1¢ to 99¢ prices imply probability (2¢ reads like roughly 2%).

- Settlement is binary: the winning side is worth $1 per contract, the other side settles to $0.

- Volume is a thermometer for attention and churn, not “truth.”

- Open interest (when shown) is a different thermometer: how many positions are still open.

- Swift contracts can whip around on headlines, but the finish line is always the rulebook.

What Are Taylor Swift Prediction Markets?

These contracts turn “Will Taylor Swift…” questions into something that can actually settle cleanly. Think chart milestones, announcement deadlines, or documented appearances. Not “how many times will she be shown live” on a broadcast, not vibes, not body-language TikToks.

That’s why Taylor Swift works here. Her world produces public signals on a schedule: Billboard updates, official posts, tour news, and regular season logistics when the Kansas City Chiefs are involved. Traders don’t just talk about the story here, they buy and sell contracts tied to what can be proven.

How Kalshi Event Contracts Work

Price, Implied Probability, And Settlement

Every contract has two sides: Yes and No.

- Prices trade from 1¢ to 99¢.

- The price implies probability. If Yes is 82¢, the crowd is pricing roughly an 82% chance of Yes.

- At settlement, the correct side is worth $1 per contract. The other side settles at $0.

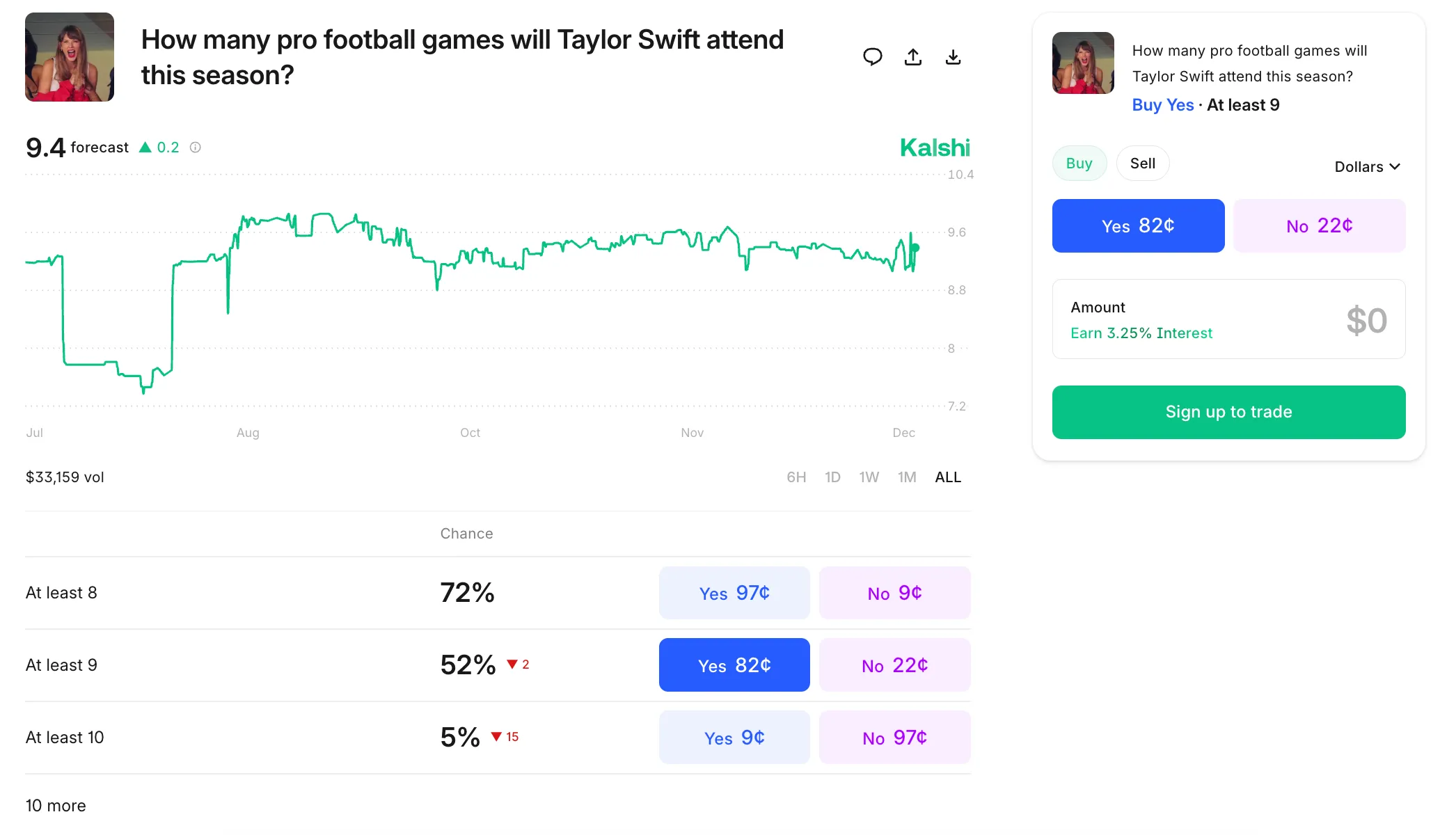

Take the “At least 9” attendance contract shown in below: Yes 82¢ / No 22¢. Mechanically, that’s it. You can open a position by buying one side, and you can close it later by selling, or you can hold through settlement. The contract’s value is always anchored to the same thing: what the rules say counts as proof at the end.

Volume and Open Interest Are Your Market Thermometers

Volume answers "how much activity has flowed through this contract?" while open interest (when shown) answers "how many contracts are still open right now?"

They’re related, but they’re not twins. You can have huge volume because everyone is changing positions in and out, and you can have high open interest because a lot of people are planted and waiting. Neither one guarantees an outcome. They just tell you how crowded and emotional the room is.

Volume ≠ Truth

A Swift contract can be loud without being optimistic. For example, a Top artist on Spotify this year contract shows $59,784 in volume while “Taylor Swift” is priced at Yes 30¢. That combo doesn’t mean traders secretly think Yes is likely. It means the contract stayed active. Volume is turnover: traders entering, exiting, and re-pricing the same outcome as new information lands.

In celebrity contracts, the crowd usually piles into the same side, trades around timing, and churns positions on every headline, chart update, or rumor correction. Treat volume like a heat map for attention and liquidity, then go read the rule and calendar. Those decide what has to happen, not the noise.

Novelty Props vs. Verifiable Settlement

Taylor Swift prop bets are usually where the Super Bowl nonsense lives: how many times will Taylor Swift be shown live, what happens after a Chiefs win, will there be a Travis Kelce kiss, what’s the national anthem angle, and every other Super Bowl prop that has nothing to do with receiving yards, team scores, or defense.

Kalshi contracts are built differently. The contracts are written around outcomes that can be verified later, with sources spelled out in the rules. Still fun, still pop culture, just a lot less “trust me.”

Latest Taylor Swift Kalshi Markets

This table was last updated on 01/05/26.

|

Market |

Latest Price Shown (Yes) |

Latest Price Shown (No) |

Volume |

|---|---|---|---|

|

Will “The Fate of Ophelia” return to #1 on the Billboard Hot 100 this year? |

99¢ |

1¢ |

$94,750 |

|

Top artist on Spotify this year? (Taylor Swift 30%) |

30¢ |

70¢ |

$59,784 |

|

Will Taylor Swift and Travis Kelce be married before Jan 1, 2027? |

89¢ |

11¢ |

$55,970 |

|

How many pro football games will Taylor Swift attend this season? (At least 5) |

99¢ |

1¢ |

$49,866 |

|

Who will attend Taylor Swift and Travis Kelce's Wedding? (Max Martin) |

70¢ |

30¢ |

$40,267 |

What These Numbers Suggest About Trader Behavior

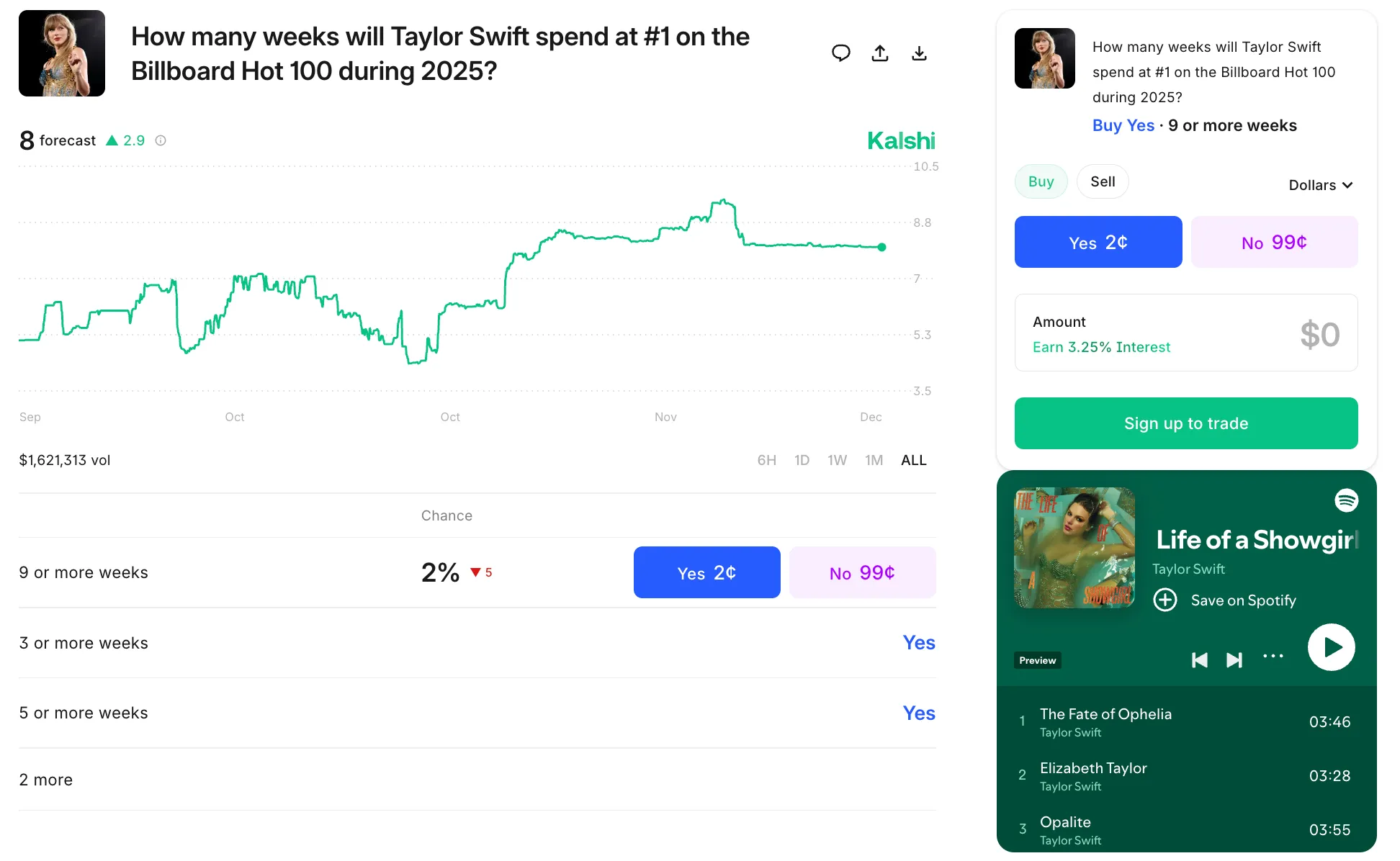

Billboard Hot 100 #1 Weeks (9+): Yes 2¢ With $1,616,729 Volume

Yes is 2¢ with $1,616,729 in volume. That’s a classic “crowded attention, lopsided belief” setup. People are clearly involved, but the pricing is basically a shrug at the 9+ threshold. This is where Swift contracts get educational: traders can keep a contract active for months while staying firmly on one side of the probability.

Rules summary: If Taylor Swift accumulates at least 9 weeks at the #1 position on Billboard Hot 100 during 2025, then the market resolves to Yes.

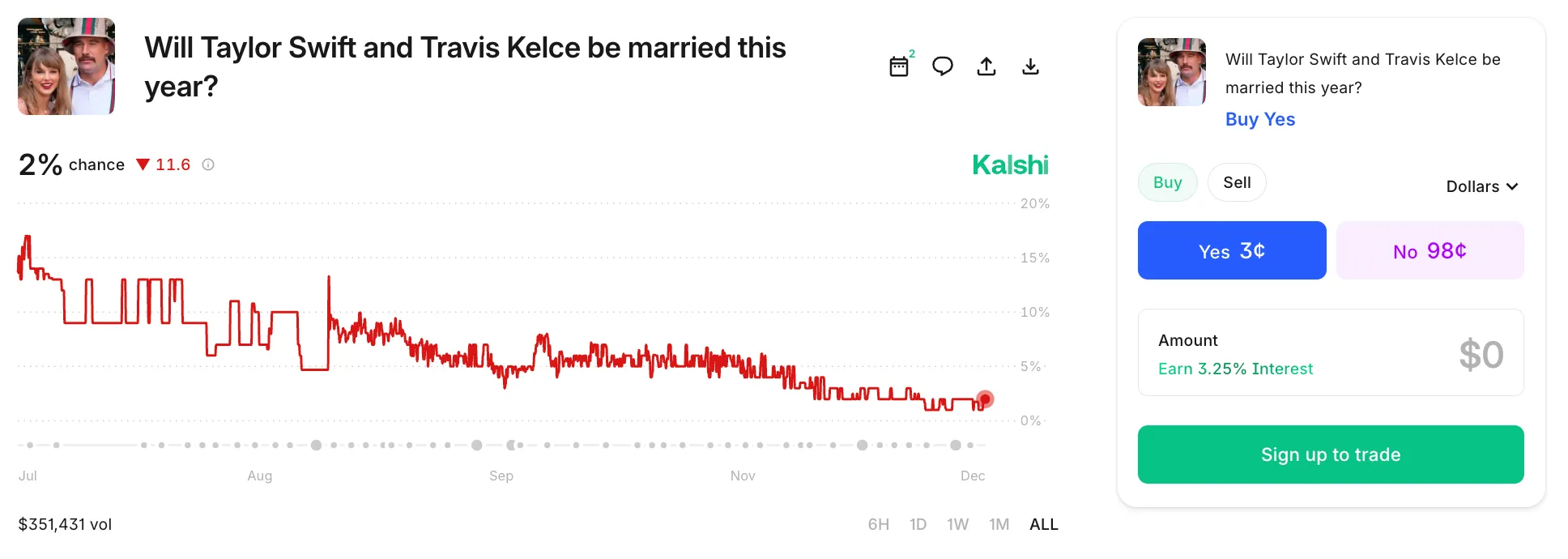

Swift + Kelce Marriage: Yes Last Traded 2¢ With $351,431 Volume

Yes last traded at 2¢ with $351,431 in volume. This reads like traders are happy to trade the storyline without upgrading the end-state outcome. The rules are strict, so the market can churn on headlines all year and still settle on a boring, checkable reality.

Rules summary: If Taylor Swift and Travis Kelce are married before Jan 1, 2026, then the market resolves to Yes.

Rumor Vs. Receipt

The Kelce marriage contract is the cleanest example of rumor trading versus receipt-based settlement. It shows $351,431 in volume while Yes last traded at 2¢. That gap usually means traders are active on headlines, not convinced on the final outcome. A photo sparks buys, a debunk sparks sells, and the volume prints either way, but settlement doesn't care what the internet decided at 2 a.m.

This contract resolves Yes only if Taylor Swift and Travis Kelce are married before Jan 1, 2026, and the rules lean on official registries and a long source hierarchy. When the proof bar is that high, rumor-driven moves can fade fast, especially the second (or third) time the same story cycles.

Reputation (Taylor’s Version) Announcement: Yes Last Traded 7¢ With $93,576 Volume

Yes last traded at 7¢ with $93,576 in volume. Still a long shot, but noticeably “more alive” than 2¢ contracts. Announcement contracts tend to drift, then jump when traders decide a hint is real, or when nothing happens and the calendar starts to matter more than a gut feeling.

Rules summary: If Reputation (Taylor's Version) has been announced before Dec 31, 2025, then the market resolves to Yes.

Taylor Swift (Taylor’s Version) Announcement: Yes Last Traded 4¢ With $55,582 Volume

Yes last traded at 4¢ with $55,582 in volume. Same structure, lower price. Traders are leaving less room for a year-end announcement here, but the contract still has enough activity to move sharply if an official post hits.

Rules summary: If Taylor Swift (Taylor's Version) has been announced before Dec 31, 2025, then the market resolves to Yes.

Other reads - Reality TV Prediction Markets

Taylor Swift + Travis Kelce: The NFL’s Most-Watched Romance

When Taylor Swift started showing up around Kansas City Chiefs game days, the NFL got a weekly plotline with built-in distribution. Travis Kelce wasn’t just running routes, he was part of the crossover episode, and football fans treated every clip like it had to mean something.

That’s also why the conversation slides into Taylor Swift prop bets and Super Bowl prop chaos so easily. You’ve seen it: how many times will Taylor be shown live, who’s in Eagles gear or Chiefs gear, etc. Throw in Super Bowl LVII flashbacks, Jalen Hurts discourse, Patrick Mahomes highlights, and random “what if it’s like the Los Angeles Rams game” spirals, and you get nonstop attention.

The difference here is that Kalshi forces that attention into something stricter: contracts tied to outcomes with receipts. Same buzz, cleaner settlement.

Other reads - Rotten Tomatoes Kalshi Prediction Markets

How Do Betting Markets Frame Swift? The Taylor Swift Effect on Sports & Markets

The “Swift Effect” is basically what happens when pop culture attention starts moving prices like it’s part of the broadcast. One Sunday it’s a normal game, the next it’s a full internet case file, and the conversation has nothing to do with team scores and everything to do with Bad Blood or Wildest Dreams playing in the background.

That doesn’t mean every contract becomes “true.” It means traders show up, volume climbs, quotes move, and people get involved. Sometimes it’s because of an announcement, sometimes it’s because the internet decided a screenshot was evidence. If you’ve watched the same thing happen with a Kendrick Lamar rumor or a Saquon Barkley headline, you already understand the pattern.

The way to stay sane is boring on purpose: treat each contract like its own rulebook. What has to happen, by when, and what counts as proof.

Other reads - GTA 6 Kalshi Prediction Markets

Novelty Prop Betting & Why Taylor Swift Is Different

Every Super Bowl comes with the same set of novelty bets: coin toss, Gatorade color, how long the national anthem will run. They’re fun, they keep casual fans entertained, and they give sportsbooks a little extra action outside of scores and receiving yards. But those props live in the shallow end of the pool. Nobody’s future hinges on whether the Gatorade is blue or orange.

Bring Taylor Swift into the mix, and the water gets a lot deeper. Her name isn’t just another novelty line item, she’s not a side bet, she's the end game. It moves prediction markets with serious money behind them. Hundreds of thousands of dollars have traded on whether she’ll headline a future Super Bowl halftime show (Kalshi saw more than $272,000 on the question of whether she would be the performer for Super Bowl LX or not). That’s not filler action, that’s real capital following the gravitational pull of a pop star.

And that’s what sets Taylor Swift prop bets apart. They don’t sit neatly beside coin tosses or anthem lengths. They sit at the crossroads of pop culture, sports, and finance, where her influence gets measured not just in chart positions or Philadelphia Eagles win totals, but in tradable contracts.

Whether you’re a Swiftie or just a bettor looking for the edge, you can feel that shift. This is proof of how celebrity, sports, and trading have fully collided.

Latest Prediction Odds

Check out some of the recent Taylor Swift Prediction Markets for January 2026.

| Taylor Swift Prediction Market | Option 1 | Option 2 | Trading Volume |

| Will “The Fate of Ophelia” return to #1 on the Billboard Hot 100 this year? | Yes (99%) | No (1%) | $94,843 |

| Top artist on Spotify this year? | Bad Bunny: 53% (Yes/No) | Taylor Swift: 30% (Yes/No) | $59,784 |

| Will Taylor Swift and Travis Kelce be married before Jan 1, 2027? | Yes (89%) | No (11%) | $56,098 |

Updated on Jan. 5, 2026.

Not really. Legal sportsbooks rarely post Taylor Swift prop bets like “how many times is she shown live” during the Super Bowl, or other novelty angles tied to the national anthem. When that stuff exists, it’s usually treated like entertainment (think Travis Kelce propose rumors or “Eagles gear” type chaos that sounds like it was written by an Eagles fan). Kalshi is different: you’re trading event contracts that settle on defined rules.

Each contract is a Yes/No question. Prices trade from 1¢ to 99¢, the price implies probability, and settlement is binary: the winning side is worth $1 per contract and the other side settles to $0. You can hold a position to settlement or close it by selling.

Because the inputs are human and the timeline is noisy. The internet trades screenshots like they’re evidence (sometimes they are, sometimes they’re not). The problem is the contract still settles on receipts, and that’s the part people forget when the story gets loud.

Trades. Prices move when people buy and sell. The biggest catalysts are official announcements, credible reporting, verifiable appearances, and milestone tracking. Rumors and debunks matter too, especially in the Travis Kelce-related contracts, because they create churn even when the underlying outcome stays unlikely.

Think of them as thermometers. Volume measures how much activity has traded over time, while open interest (when shown) measures how many positions are still open. High volume can mean a frenzy, high open interest can mean a crowded view. Neither one guarantees what will happen.