Casino revenue is reaching new heights in the Hoosier State.

Total statewide revenue rose from $200.2 million to $204.2 million, with six of the state's 13 casinos reporting revenue increases compared to August of the previous year. This growth signifies a steady rebound following more moderate or flat outcomes earlier in the summer, showcasing both stability and strategic gains among the leading operators.

This, as another Indiana casino considers a relocation plan to improve its bottom line.

Revenue Breakdown and Market Context

The six casinos responsible for the year-over-year growth accounted for the majority of the overall revenue increase.

The leading contributors to this upward momentum were regional destination venues. Both Horseshoe Indianapolis and Horseshoe Hammond, operated by Caesars, had the biggest revenue increases in August.

- Horseshoe Casino Hammond saw its revenue jump by over 30%, going from $18.9 million to $24.6 million.

- Horseshoe Indianapolis saw an 11% increase, with revenue rising from $25.2 million to just over $28 million.

- Hard Rock Casino Northern Indiana brought in the highest revenue amount in the state, totaling $34.3 million. However, this was a decrease of 6.1% compared to $36.6 million in August 2024.

- Rising Star Casino had the lowest revenue in the state at $3.4 million and experienced the largest year-over-year decrease, dropping 11% from $3.8 million the previous year.

- Ameristar Casino also saw a significant drop, with revenue falling by 8.9%, from $13.6 million to $12.4 million.

Indiana's casino market continues to rely heavily on in-person gaming activities, as online gaming (iGaming) remains illegal in the state. Thus, the revenue figures reflect only land-based casino operations.

Casinos in Indiana Contribute Significant Tax Dollars

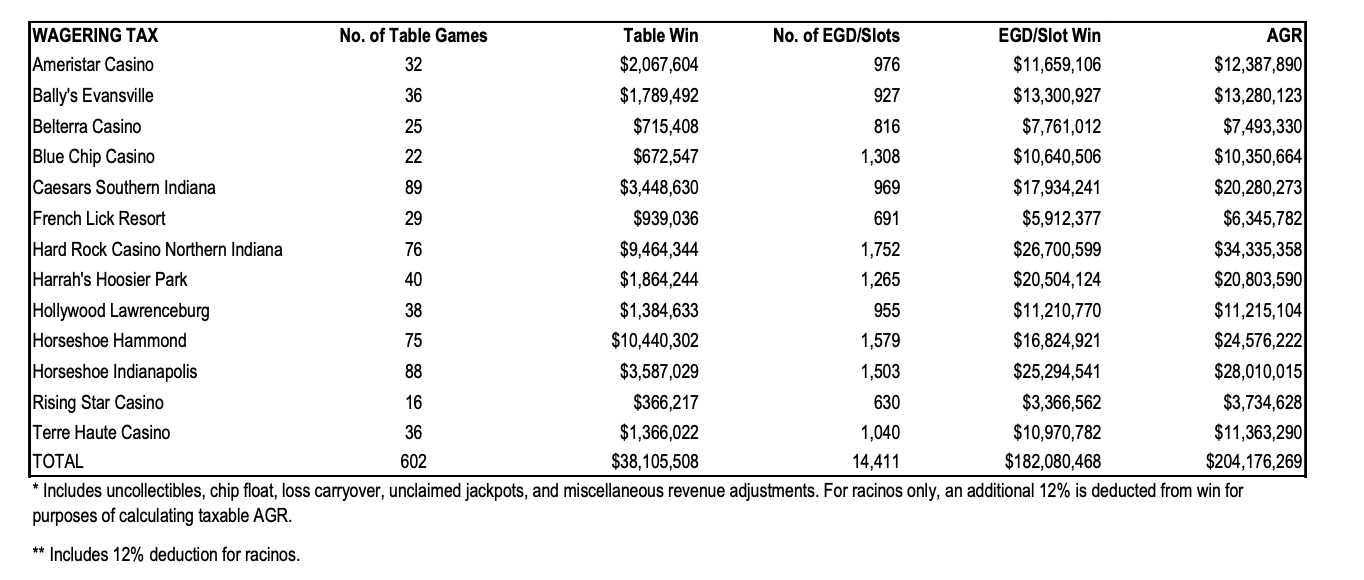

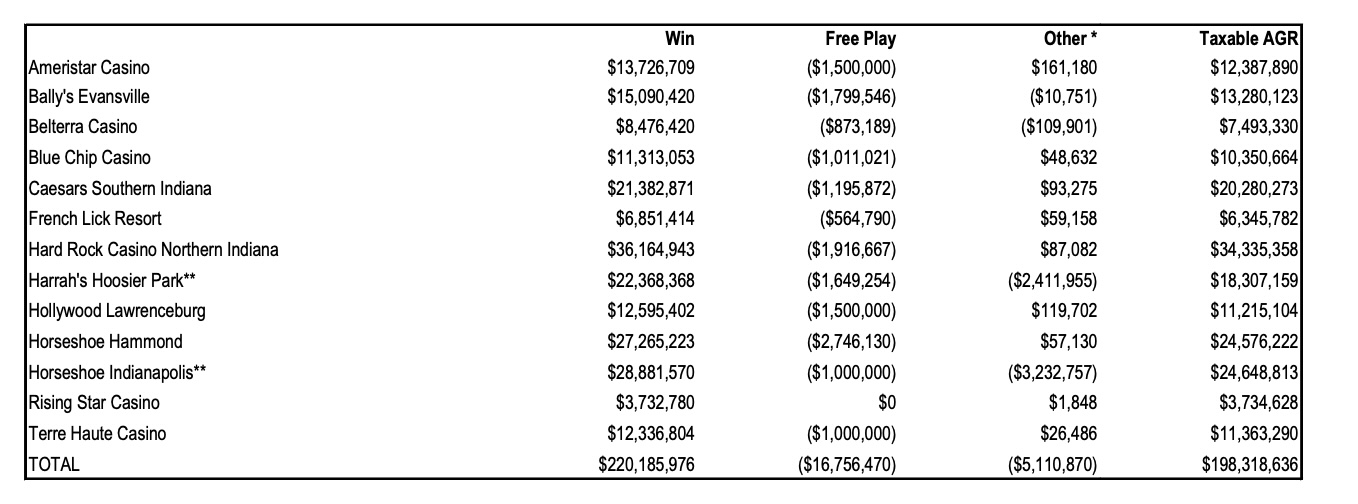

Indiana casinos paid a significant amount in taxes in August 2025, thanks to a multi-layered tax system in the state. The taxes they pay include:

Wagering Tax: This is based on a sliding scale tied to casino earnings. It ranges from 15% for the first $25 million a casino earns, to 40% for earnings over $600 million. Racetrack casinos, or "racinos," have different rates: 25% for up to $100 million, 30% for $100-200 million, and 35% for more than $200 million.

Supplemental Tax: This can be up to 3.5% of the total gaming revenue for regular casinos, with racinos possibly paying slightly lower rates.

August 2025 Tax Highlights

- Total Casino Earnings: $204,176,269

- Wagering Tax Collected: $16,756,470

- Supplemental Tax Collected: $5,110,870

- Total Tax Collected (Wagering + Supplemental): $21,867,340

Each casino paid different amounts based on their earnings and the tax rates they fell under.

The taxes collected in August 2025 supported various state and local projects and showed a small increase from the previous year.

Indiana’s tax system is known for its high rates, particularly for big casinos earning over $600 million a year. This information, shared by the Indiana Gaming Commission, highlights how important casino taxes are for the state budget.

Indiana Casinos Continue to Thrive Despite Challenges

Indiana's traditional casinos are holding up well despite tough competition in the Great Lakes and Midwest areas.

Large casinos, particularly those located near major cities such as Indianapolis and state borders with Illinois and Kentucky, play a crucial role in increasing the state's total revenue. The August numbers also build on positive results from July, continuing an encouraging trend after a slow start to the summer.

These revenue figures indicate that the casino industry, both in the region and nationally, is stabilizing. It's happening even with economic challenges like inflation and changes in how people choose to spend their money.

The outcomes suggest Indiana's commercial casino industry is demonstrating adaptability to current market dynamics, continuing to generate meaningful tax revenue for the state.

Online Casinos in Indiana: Current Status and Legal Landscape

Indiana residents still do not have access to legal real-money online casinos. While the state has approved online sports betting and daily fantasy sports, efforts to legalize online casinos have yet to succeed.

Legislative Efforts and Challenges

Several bills, including HB 1432, have been introduced to legalize online casinos, but none have moved forward in the legislative process this year. The main challenges include:

- Political Resistance: Some lawmakers oppose expanding gambling activities.

- Impact Concerns: There are worries about how online casinos might affect existing land-based casino revenues.

- Past Scandals: Previous corruption scandals related to gambling laws add to the hesitation.

Legal Alternatives: Sweepstakes Casinos

Although real-money online casinos are not allowed, Indiana residents can participate in sweepstakes casinos. These are legal under federal and state laws because they operate differently:

- Virtual Currency: Players use virtual currencies like Gold Coins for fun and Sweepstakes Coins for redeemable prizes.

- No Purchase Required: Participation does not require any purchase, ensuring compliance with sweepstakes rules.

- Legal Compliance: These platforms abide by laws, confirming players are 21 or older and separating real-money gambling from prize-based games.

Sweepstakes casinos are permitted as long as they meet these conditions, which makes them a legal and popular alternative. Just remember to always exhibit responsible gambling habits.