The allure of the casino and the lottery stems from the tantalizing possibility of getting rich quickly with minimal investment.

Unfortunately, scammers know this all too well, and they exploit this hope to trick unsuspecting individuals into handing over their money and personal information.

Vegas Insider, a data-driven platform that analyzes how emotion, technology, and regulation intersect in gambling and risk, looked at Federal Trade Commission data from the past five years. Their researchers wanted to see which states are affected most by lottery scams, how much people are losing, and the tactics they're using to rip people off. They also created a Victim Impact Score by looking at both the total money lost and the number of reports for each person.

It’s one of the most detailed looks at how prize and lottery scams have evolved across the country.

Lottery Scams Cost Americans Millions Each Year

The United States is no stranger to gaming, lottery and prize scams. From Ponzi schemes tied to casinos, to ways people try to cheat at individual table games like Baccarat, the gambling industry is always looking for ways to fight back.

However, individual lottery scams are specifically targeted, and often, the victim never sees them coming.

According to the data, Americans have lost around $660 million to lottery and sweepstakes scams since 2020. Alarmingly, $351 million was lost in 2024 alone, the highest on record, highlighting significant growth in these scams.

Each victim typically loses about $1,300, although older individuals often report much larger losses. More troubling is the 148% increase in impersonation scams last year due to AI voice cloning and fake verification sites.

It's not just the financial loss that affects victims; the embarrassment of being deceived often leads to crimes going unreported.

Which States Are Affected Most By Lottery and Prize Scams?

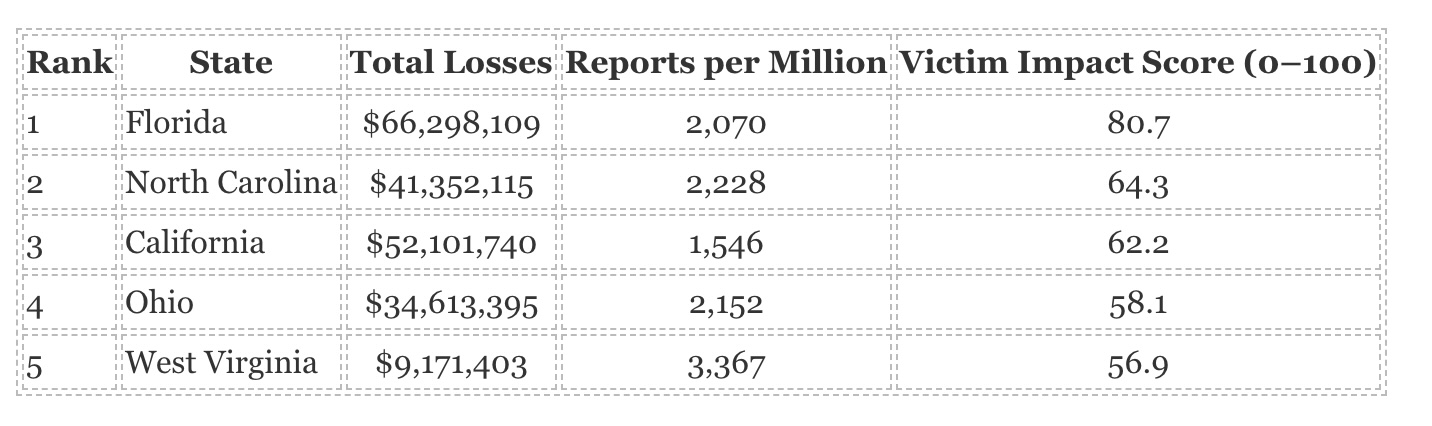

The Federal Trade Commission data shows that the top 5 states where lottery scams are most common and impact people the most, include:

- Florida: Large retiree population and phone-based scams.

- North Carolina: High levels of lottery participation combined with active online involvement.

- California: Social media and influencer-related scams.

- Ohio: Strong lottery participation and digital engagement.

- West Virginia: High per-capita loss due to small, trust-centered communities.

These states show higher losses due to factors like age demographics and active lottery participation. Here's a look at just how much money has been stolen over the past five years (2020-2025) in the top 5 states:

But states like Wyoming, Vermont, and Maine benefit from smaller populations and heightened local awareness, which contributes to their minimal rates of fraud.

Who Are Lottery Scammers Targeting?

Seniors are frequently targeted through convincing phone calls and letters. Also, people who display a high level of online activity are also vulnerable. Scammers often use phishing to make fraudulent messages appear credible.

Anybody with a phone can also fall victim. Scammers use local area codes and familiar lottery terminology to build trust.

Navigating the Minefield of Lottery Fraud

In the digital age, the thrill of potentially winning big has been exploited by scammers who use increasingly sophisticated tactics. Recognizing these scam strategies and knowing how to identify a fake offer can save you from financial loss and emotional distress.

Common Lottery Scam Tactics

Scammers employ a variety of methods to deceive their victims. Here are three of the most prevalent tactics:

Fake "Second-Chance" Drawings: Scammers lure individuals with the promise of another chance to win, often requiring victims to pay verification or tax fees before they can claim their alleged winnings.

Spoofed Numbers and AI-Generated Voices: These scams involve criminals imitating official Lottery personnel or Publishers Clearing House staff members, using technology to make fake calls sound more credible.

Social Media Messages Announcing Fake Winnings: Scammers use social media platforms to announce fake prize winnings, tricking victims into releasing personal information or paying upfront fees.

Scammers will also mail checks requesting payments before releasing funds, or claim they are collecting small "donations" for a charity that doesn't exist.

Identifying a Prize Scam

Being able to spot a scam is crucial to protecting yourself. It's important to remember that legitimate notifications don't come via social media or text.

You should always verify an inquiry like this by contacting the official websites or verified numbers directly, and speaking with someone who actually works for the company telling you that you've "won."

Here are some key indicators:

Participation Check: Always question unexpected win notifications, especially if you didn't enter a contest.

Fee Rule: Legitimate prizes never require you to pay upfront. Any request for payment is a major red flag indicating a scam.

Urgency Cue: Scammers often pressure victims to act quickly or keep their "win" a secret. Real winnings don’t have sudden expiration dates, and legitimate organizations won’t rush or threaten you.

By understanding these tactics and warning signs, you can navigate the enticing but hazardous landscape of lottery and sweepstakes offers with confidence and security.

Use Vegas Insider’s Five Golden Rules to Avoid Being Scammed

Increasing awareness and persistence in verification are the strongest defenses against prize and lottery scams. To stay safe, it's best to implement Vegas Insider's five golden rules:

- Entry Equals Eligibility: If you didn’t enter, you can’t win.

- Fees Equal Fraud: Real prizes never demand payment.

- Social Media Is Not Official: Prize announcements via Direct Messages (DMs) or texts are fake.

- Pressure Tells: Urgency and secrecy can indicate a scam.

- Trust But Verify: Always confirm directly with the organization.

Understanding the nature and scope of lottery scams is crucial. Scammers leverage the thrill of potential winnings to get what they really want—your money or your information.

What if You're Already a Victim?

Dealing with the aftermath of a lottery scam can be overwhelming, but taking swift action can mitigate further damage and help authorities catch those responsible. Here are the steps you need to take immediately if you find yourself a victim of a scam.

Immediate Actions

- Stop Contact: Immediately cease all communication with the scammers to prevent further manipulation.

- Protect Accounts: Alert your bank or credit card provider to secure your financial accounts.

- Change Passwords: Update all your online account passwords and enable two-factor authentication for an additional layer of security.

- Save Evidence: Keep a detailed record of all communication, including screenshots, emails, and receipts, which can help law enforcement trace the fraudsters.

- Report the Scam: Even if you haven’t lost money, reporting the scam can aid in protecting others from falling victim.

Reporting Resources

- FTC: Visit ReportFraud.FTC.gov or call 1-877-FTC-HELP (382-4357) for federal assistance.

- Attorney General: Visit the website of your state's Attorney General

- Consumer Protection Agency: Reach out to the Consumer Protection Section at 800-282-0515.

- BBB Scam Tracker: Report scams at BBB.org/scamtracker.

- FBI IC3: File internet crime reports at IC3.gov.

- Local Police: Contact local law enforcement, especially if you've suffered financial loss or identity theft.

Taking these steps promptly can help you regain control over your personal information and financial security, and can offer invaluable support to agencies fighting against these fraudulent activities. Stay informed, stay cautious, and always prioritize your protection.