- Cryptocurrency took a free fall in the market on Wednesday morning

- Bitcoin and other top crypto markets dropped over 20 percent

- Darren Rovell lists his reasons why the crash happened

On Wednesday morning, crypto was one of the more pressing searches based on a simple experiment.

I typed in the words “Why is” in Google on Wednesday morning as an experiment. The words that followed as suggestions?

…the sky blue? …my poop green? …my eye twitching?

And, of course… Why is crypto down?

I actually don’t know why the sky is blue, but I know why the crypto question has crept into the top five.

It has taken over our world, our curiosity, our dinner conversations. It has, in some cases, replaced betting for those who bet.

In a short time, roughly 14 percent of America has some holding in crypto, according to a recent survey. It doesn’t seem like a lot, until you realize that only 55 percent of America is invested in the stock market.

The value of cryptocurrency tokens rose in April to more than $2 trillion and the recent slide over the last week has caused $600 billion to be erased, according to tokens tracked by CoinGecko.

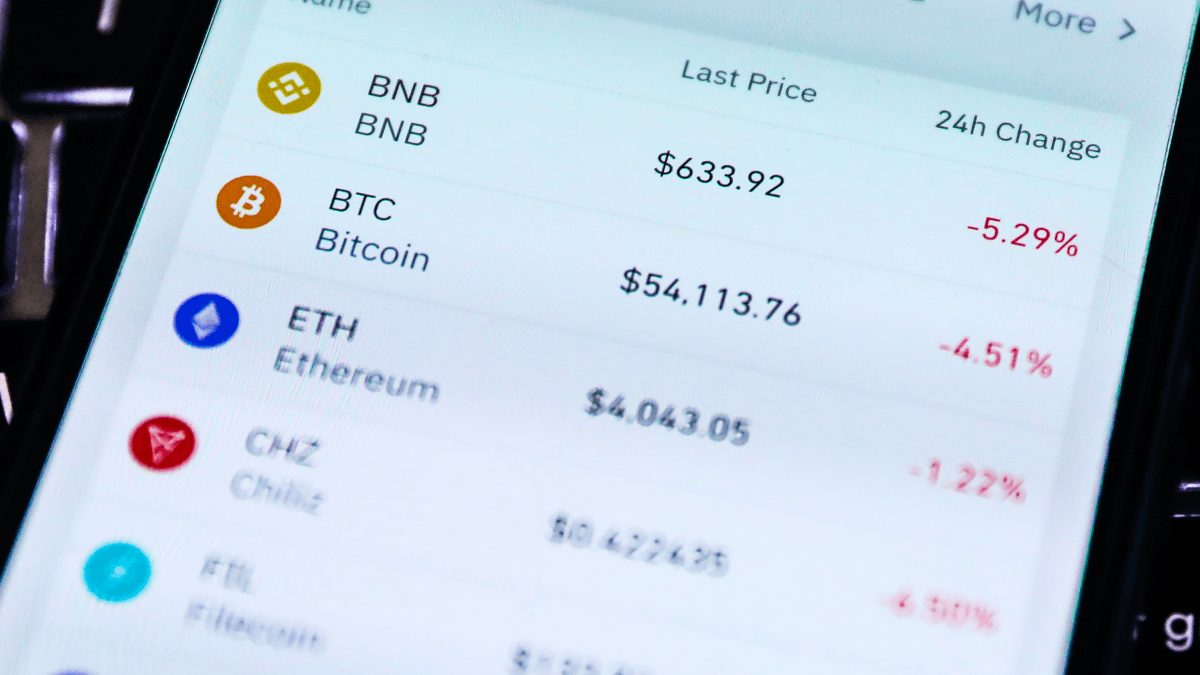

Bitcoin, which hit $60,000 in March, was hovering close to $30,000 on Wednesday morning. Ethereum, which hit $4,000 just 9 days ago, was threatening to go under $2,000.

On Twitter on Tuesday, I asked sports bettors if investing in cryptocurrency had satisfied their need or like for betting. An astounding 40 percent said it had.

If you are a sports bettor, who has at least dabbled in crypto, do you find you are betting on sports less because the 24-7 crypto cycle occupies that fix?

— Darren Rovell (@darrenrovell) May 18, 2021

Still skeptical about a direct connection? Google Trends data shows that the top state in its index searching about crypto? Nevada!

So let’s get to the meat. Why is crypto down?

Everything doesn’t always go up

Despite what those who have recently invested in crypto have witnessed over the last six months, Isaac Newton’s law of gravity still applies. Joe DiMaggio’s hitting streak stopped at 56. Bettors, more often than not, lose it all on the last leg of a parlay. Making money isn’t easy, even though crypto certainly made it seem that way.

In another Twitter poll that I took last week, those who voted said crypto was easier to win at than other popular ways to make money.

Of these, which do you feel is the easiest way to make money today?

— Darren Rovell (@darrenrovell) May 14, 2021

Incoming Government Regulation

For so long, crypto lovers have talked about how cryptocurrency is decentralized. While most talk openly about how this is their risk against inflation of currency as the government hands out more money, it’s just as much about the flow of it being harder to trace, so the tax consequences seem less.

But as more of America gets into it, it’s not some secret and Uncle Sam is going to get their piece. When crypto is turned into cash it automatically becomes a taxable event. Some have sought to go around this by transferring their money in a coin to a stable coin that mimics the America dollar on a one-to-one basis. But now that $15 billion is in US Dollar stable coin, is it really that much of a secret?

Elon Musk

Crypto is heavily based on momentum and was protected, seemingly, from dropping big thanks to those in it who would prop it up. Their protection? They would easily dismiss someone who crapped on their coin of choice by saying it was just hatred that they didn't get in on the success.

No matter how big the voice, it was always defendable with the whole jealousy argument or the old guy is upset that this is rocking the establishment.

Take Charlie Munger, Warren Buffett's 97-year-old partner at Berkshire Hathaway, who earlier this month called Bitcoin "disgusting and contrary to the interests of civilization." The crypto pumpers were successfully able to dismiss a guy of Munger's status by saying he didn't have credibility in the space.

Solved.

Until Elon Musk came along.

The problem with Musk is that he proved to be both the disciple who helped boost crypto, and in recent days, reversed course, saying that bitcoin mining and transactions took up precious energy. As the third-richest man in the world, Musk has other interests at mind other than making money at all costs and that's a huge concern to the crypto heads who say they will "HODL" at all costs.

The Dark Side

Cryptocurrency and the blockchain is genius in many ways. Ease of payment (sometimes) and smart contracts are often mentioned as No. 1. But the fact that it can't be traced in the same way real currency can also gives it a dark side that frankly has been pushed aside in the excitement of the rise.

Years ago, the No. 1 talk over cryptocurrency wasn't how smart it was, or how much a part of the future it was, it was talked about as the preferred currency for crooks and criminals and for money launderers.

That's still very much the case. It's why China has made crypto illegal since 2019. People still did it, which led to three Chinese organizations that back money in the country to say this week that they would not back any crypto losses made through transactions.

Munger, in his comments, said that he didn't like "shuffling out of your extra billions of billions of dollars to somebody who just invented a new financial product out of thin air," but he also said he didn't "welcome a currency that's so useful to kidnappers and extortionists."

Fundamentals are harder to explain

As someone who worked at CNBC for six years, I'm very well aware that there's not a direct correlation between how a company is doing based on its reporting and the stock price.

There is momentum. There are shareholders and analysts who drive price up and down based on feeling. I'm also not dismissing that there are fundamentals tied to cryptocurrency. But it is much harder to explain crypto and half lives and everything that comes along with it to the population that is now coming into it.

It's not hocus pocus, but it takes a lot of work to get through.

It's not as simple as Lululemon sells athleisure gear and athleisure gear is on fire. What does that mean? It means that when this world gets tested, and it's not all about money, it's harder to bounce back for the casual crowd that just got into it.