When Mage crossed the finish line first at Churchill Downs on Saturday, it marked the second time in four years that a fractional ownership company had a piece of the Kentucky Derby winner.

Commonwealth (CMNWLTH) — an app that offers shares in horses and soon athletes in other sports — offered its users a chance to buy pieces of a 25% stake in Mage. The auctions closed in January before its maiden race.

App users could pay $50 per share for part of the horse. And, man, has that investment already paid off. Owners were awarded about $95 per share for Mage's Kentucky Derby victory and can cash in further if the horse does well in future races. Shareholders will also receive payouts every time Mage produces offspring — also known as stud fees or stallion rights. For reference, 2020's Kentucky Derby winner Authentic has a stud fee of roughly $70,000 per cover.

While a celebration video of Commonwealth CEO Brian Doxtator went viral, not much is known about the platform except from a quick mention by NBC's Mike Tirico. So we did a deep dive with Doxtator.

Horse racing has always had syndication with owners, so fractionalization is not a new idea. Where did the idea of Commonwealth come from?

Doxtator: I'm from the startup world, from New York, San Francisco and LA, not Louisville. I am a car guy and I was at a car auction in 2018 and there was a tent where you could buy shares of a Lamborghini and it was Rally. From there, I kind of studied them and reverse engineered it around the idea of being an owner in things where you would not only benefit financially, but that you would have an experiential calendar around what you owned.

When you started Commonwealth, did you ever believe you could have this type of success? Last year, your horse Country Grammer earned more than $10 million on the track after winning the Dubai World Cup.

Doxtator: I always thought it could happen, just not this quickly. One of the core theses of the model, as we scale the odds, is to have big winners. We had Country Grammer, another horse was the favorite in the Belmont and finished fourth and now Mage. The early results have exceeded all expectations and dreams.

How do you ensure that type of hit rate?

Doxtator: Great scouting. Great partners. On top of that, we don't sell shares in every horse we acquire. We have a rigorous, high quality bar. The ones we don't think will make it, we take a loss rather than put that on our members.

Really?

Doxtator: We had one horse named Six Missions. One of our members asked about why we weren't offering it, since he saw we owned it, and we just said, 'He's a fine horse, just not a stakes horse.'

There have been some horror stories in fractional ownership, most notably with MyRacehorse and Authentic. Investors won the Derby, but then were told that the money was going towards paying the original owners a kicker. How are you different?

Doxtator: It's a big difference. For Authentic, they bought in only on a stallion deal, which is why the economics were upside down. We are on the auction valuation and our members get pieces of the prize money and if there's a stallion deal. There have been some bad stories and, to be honest, I have been waiting for the day to make the situation right.

I don't want to gas competitors, who are buying at track signing, but we're not talking to people already in horse racing. We're talking to people who are general sports fans, who have been to the track, maybe, a couple times. They bet on a horse because they like the name and there's nothing wrong with that. But they want to do this because they want to connect to the experience. It's why the average age of our investor is 36 compared to 58 in horse racing.

Let's get into the nitty gritty. Your SEC documents say you bought a 25% stake in the horse for $72,000, but the offering for Mage was for $171,400. Why is that?

Doxtator: Let me be clear that we are not marking up the horse. The bulk of the markup is our percentage we have to pay on two years of annual training expenses, which are $70,000 a year.

(Note to the reader: This is all fully disclosed. Of the $50 share price, 47% goes to acquire the horse, 17.5% goes to training, 14.3% working capital reserve, 10% on offering expenses, 6.7% on management fees and 2% after care donation).

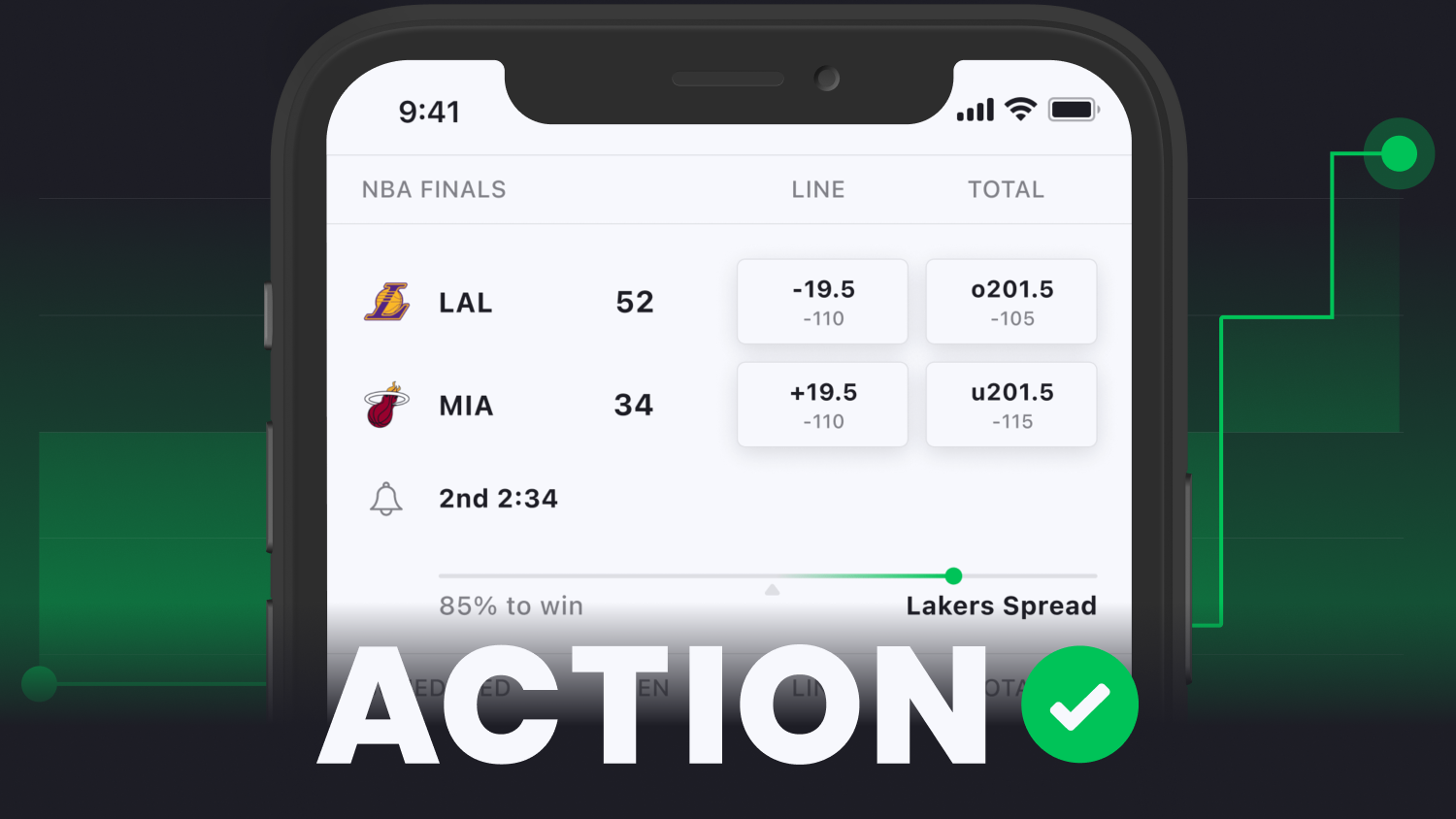

I know you are still doing calculations, but those who did own a piece of the horse would receive roughly $95 per $50 share. It was pointed out on Twitter that you could just bet on the horse and make more?

Doxtator: Well, there's more money coming and you still couldn't say that you were an owner. The joy of this all is the story and the experience. You get owner updates about the horse and you can be there too.

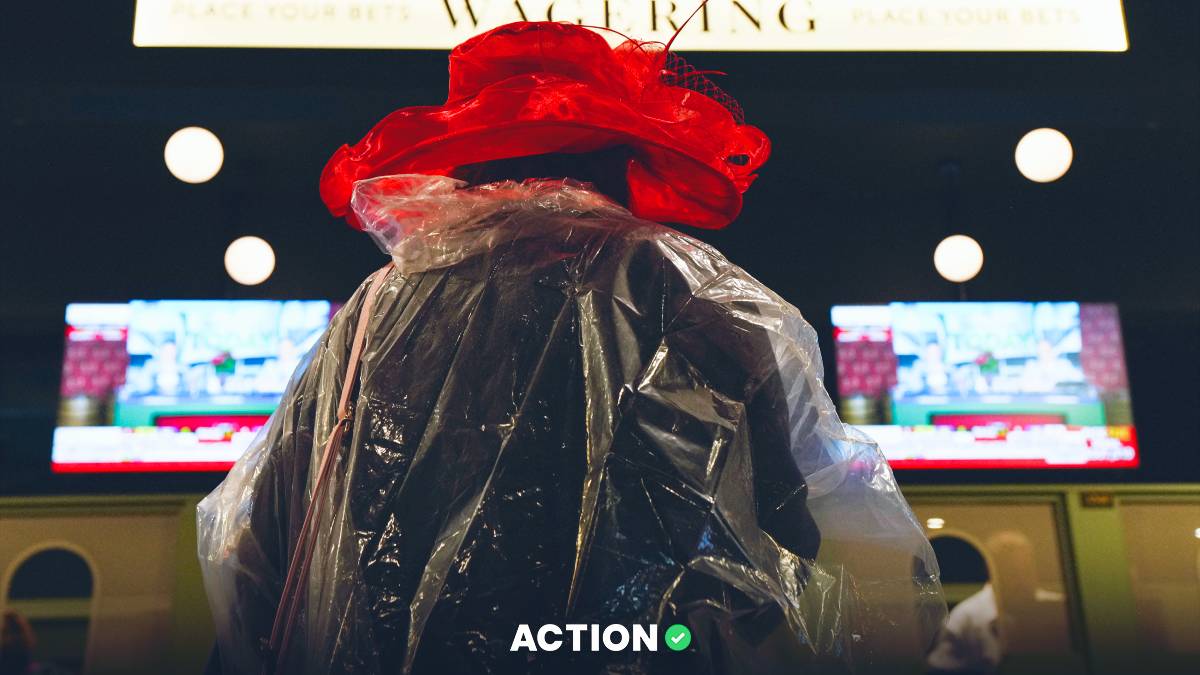

OK, so I saw that part of the offering. I also know you have about 390 investors on your piece. If you invest $2,500 in Mage, you have access to workouts and the winner's circle and some other things. How does now winning the Kentucky Derby complicate this?

Doxtator: There are 25-30 people who have an interest of $2,500 or more in Mage. We've been delivering to our investors on the experience. We had a ton of people at Santa Anita and on Pegasus Day at Gulfstream, where Mage ran his maiden race and then again at the Florida Derby, where he barely lost to Forte. We even had 30 people in Dubai! But we've have $50 share owners in the paddock before and even the smallest investor feels it. For most races, we text our owners so they can watch live and have that experience they bought into.

Let's talk a little about liquidity. Some other fractional sites have had trouble because they didn't solve the flow of money. There's friction between wanting to sell and finding a buyer and the time it takes hurts the investment. How do you solve for this?

Doxtator: We have an actual wallet directly in the account, so when you get your money, you can cash out or reinvest. I'm happy to say that 70% of people that first invested, invest again. But if you want to cash out you can. But, admittedly, everything is not smooth, as it's not all in our control. Our horse came in second in Dubai in February and we still haven't gotten the money. We can't afford to front $1 million.

Were you able to capitalize on the grand stage the win provided?

Doxtator: We had a $180,000 offering for a horse that immediately sold out on Saturday and we have another one today. Those were the two we had ready and we might have two more before the Preakness.

Where do you go from here?

Doxtator: So I talked before about keeping the quality bar up. In order to do that, you can't just stay in horse racing. Ideally, we'll have 30-50 horses. We are branching out into golf, so we would have at least 30 golfers and after that, we'll probably go into tennis.