Sharp bettors never force action. They only get down when they see value. Some nights it might be 10 games, other nights they'll lay off entirely if nothing valuable stands out. It's totally dependent on the matchups. Lucky for us, tonight's board is one that the sharps seem to love.

After breaking down all the lines and percentages, here are the six college basketball bets (three starting at 7 p.m. and three starting at 9 p.m. ET) the professional players are getting down on tonight.

For a full glossary betting of terms, plus the sides getting the highest percentage of tickets and money, check out the bottom of the article.

All data as of 3:45 p.m. ET

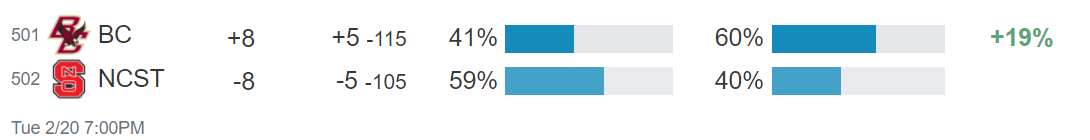

Boston College (+5) at NC State

7 p.m. ET

We've seen tremendous sharp action on the road dog Eagles. The game opened at Boston College +8 and sharps have steamed BC all the way down to +5. The Eagles also enjoy a profitable bet vs dollar discrepancy: they're only getting 41% of bets but it accounts for 60% of dollars. This means that the big, sharp wagers are on BC and the five-dollar Average Joes are on the home favorite Wolfpack. Wiseguys first hit BC +6.5, then the whole market adjusted the number down to +5.

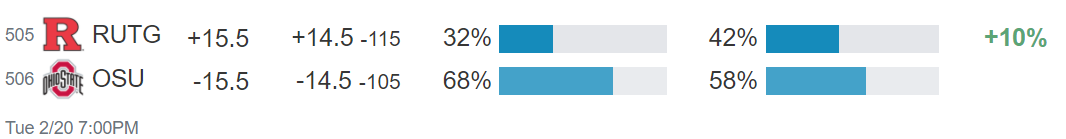

Rutgers (+14.5) at Ohio State

7 p.m. ET

Despite the massive spread, public bettors are still loading up on Ohio State. Why? Because recreational bettors overvalue win-loss records and love betting favorites, home teams and trendy schools. The 22-7 Buckeyes fit all three criteria. However, sharps like 13-16 Rutgers to cover the big number. Despite receiving only 32% of bets, Rutgers is getting 42% of dollars, a sign of the big, sharp wagers grabbing the points, not laying them. Plus, Rutgers has moved from +16 down to +14.5. This indicates sharp reverse line movement on the Scarlet Knights. Sharps first hit Rutgers +15.5 at the Greek, then the entire market adjusted the line.

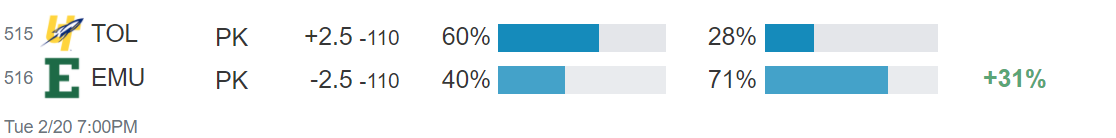

Toledo at Eastern Michigan (-2.5)

7 p.m. ET

Oddsmakers opened this MAC showdown at a pick'em and of course the public is going with 19-8 Toledo (60% of bets). However, the percentages and movement indicate sharp action on 16-11 Eastern Michigan. EMU is only getting 40% of bets (but it accounts for 71% of dollars) and the line moved huge in their direction (pick'em to -2.5). This was caused by a pair of profitable bet signals.

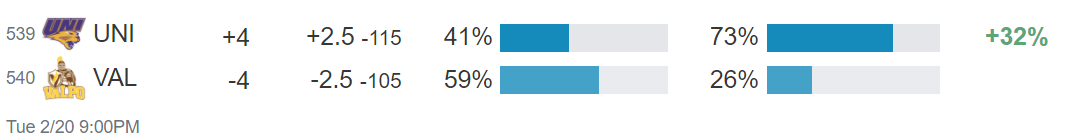

Northern Iowa (+2.5) at Valparaiso

9 p.m. ET

This isn't the sexiest game of the night, but sharps don't mind. In a conference showdown between two sub-.500 teams, the public is siding with 14-15 Valpo because they're the home favorite with the slightly better record. However, sharps see 13-15 Northern Iowa as the under-the-radar smart money play. UNI enjoys a massive bet vs dollar discrepancy (only 41% of bets but 73% of dollars) and the line has moved big in their favor since opening (+4 to +2.5).

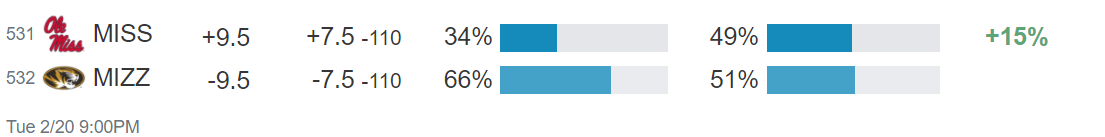

Mississippi (+7.5) at Missouri

9 p.m. ET

Ole Miss checks off all the sharp boxes. Even better, they were PJ Walsh's Wake and Rake early play. Enough said. The Rebels (11-16) are only getting 34% of bets but it accounts for nearly half the money. Plus, despite two-thirds of bets taking home favorite Missouri (18-9), the line has moved two full points toward Ole Miss (+9.5 to +7.5). This movement was caused by an overload of sharp action on the road dog Rebels +9, causing the market to drop the line all the way to +7.5.

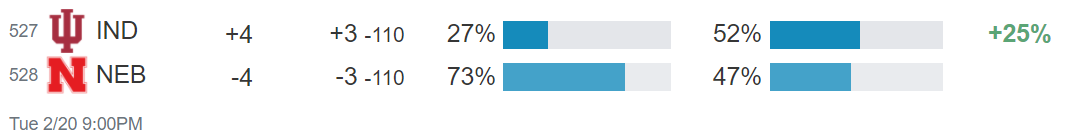

Indiana (+3) at Nebraska

9 p.m. ET

In the final game of the night, sharp bettors are staying up late and rooting for the Hoosiers. Indiana is only getting 27% of bets but a whopping 52% of dollars, an excellent indication that sharp wagers are siding with the road dog. Meanwhile, even though 73% of bettors are taking 20-9 Nebraska, the line has fallen from Cornhuskers -4 to -3. Why would the books drop the number to give public Nebraska bettors a better number? Because they have big liability on Indiana. Early this morning, wiseguys got down hard on Indiana +4, causing the line to fall across the market.

A few reminders:

- A really high bet percentage is usually a clear indicator of who public bettors (aka the guys who don’t do this for a living) are taking. And breaking news: The majority of public bettors aren’t successful over the long haul.

- To help locate which games the pros are on, focus on the money percentage metric. If a team is getting a much higher share of dollars compared to bets, that’s a good sign that the wiseguys are on them.

- Don’t blindly bet games based on percentages. You also have to look at the line movement. One of the best sharp indicators is Reverse Line Movement: when the betting line moves in the opposite direction of the team the public is betting. Example: Duke is getting 75% of spread bets vs. North Carolina but you see the line move from Duke -1 to +1.5. That’s a sure sign the wiseguys are on UNC.

Thirsty for more in-depth betting analysis? Sign up for a Sports Insights Pro trial and join our Live Betting Hangouts where we break down the entire board every weeknight from 6:30-7 p.m. ET.

The Pro membership also gives you a fully customizable live odds page with lines from 50+ books, the number of bets on every game, best bet picks, steam and reverse line moves, Sharp Action Report, weather, injuries, line watcher, line predictor and more.

For more betting updates, be sure to follow us on twitter @ActionNetworkHQ

Top Photo: Indiana Hoosiers guard Juwan Morgan

Cover Photo Via Jeffrey Becker-USA TODAY Sports