- What's next for this year's Super Bowl odds?

- With reporting on current market dynamics, Avery Yang breaks down what lies ahead for the Super Bowl spread between the Bengals and Rams.

When Caesars Sportsbook's assistant director of trading Adam Pullen set the opening Super Bowl line at Rams -3.5, he thought the spread could've even been at the key number of -3.

That's the line, Rams -3, he had set for a Super Bowl lookahead spread before the conclusion of the AFC and NFC Championship games.

And yet, despite his inclinations, the odds have gone in the complete opposite direction. As of Monday morning, the line sits at its current market consensus of Rams -4.5.

"Personally, I don't see the line moving any higher toward the Rams, but I didn't think it'd move any higher than four," Pullen said with a chuckle. "I don't pretend to know everything — I'm not right all the time."

It's rather common for the market to move against even a bookmaker's better instincts.

While sportsbooks do set the initial line as they please, like you and I, they're privy to the same uncontrollable market factors that force odds movement in one direction or another.

In this case, it's sharp action that did the trick. At certain books, Caesars included, sharp action is the single biggest determinant as to whether a line moves. On the same day Caesars opened Super Bowl odds at Rams -3.5, a $180,000 wager on Los Angeles to cover moved the line to Rams -4.

The difference between Rams -3 and Rams -4 is substantial. Betting veterans know this. Receiving more than a field goal cushion in any game between two good teams is significant — but especially for a game like the Super Bowl.

Since 2000, only two teams have covered as 4-point favorites or more. That's an against-the-spread (ATS) record of 2-10-1. Favorites of three or fewer points, though, went 5-3 ATS over this timeframe.

NFL Super Bowl Favorites of 4 or More Points Since 2000

| Super Bowl | Odds | Result |

|---|---|---|

| 2018: Eagles 41, Patriots 33 | Patriots -4.5 | LOSS |

| 2016: Broncos 24, Panthers 10 | Panthers -4.5 | LOSS |

| 2013: Ravens 34, 49ers 31 | 49ers -4.5 | LOSS |

| 2010: Saints 31, Colts 17 | Colts -5 | LOSS |

| 2009: Steelers 27, Cardinals 23 | Steelers -7 | LOSS |

| 2008: Giants 17, Patriots 14 | Patriots -12 | LOSS |

| 2007: Colts 29, Bears 17 | Colts -7 | WIN |

| 2006: Steelers 21, Seahawks 10 | Steelers -4 | WIN |

| 2005: Patriots 24, Eagles 21 | Patriots -7 | LOSS |

| 2004: Patriots 32, Panthers 29 | Patriots -7 | LOSS |

| 2003: Bucs 48, Raiders 21 | Raiders -4 | LOSS |

| 2001: Patriots 20, Rams 17 | Rams -14 | LOSS |

| 2000: Rams 23, Titans 16 | Rams -7 | PUSH |

And after the line had already moved to a market consensus of Rams -4, a different bettor slapped down $522,000 on the Rams to cover.

This bettor single-handedly moved the book's line from Rams -4 to Rams -4.5, and much of the rest of the market followed.

Both big moneyed bettors had previously been flagged by Caesars as a sharp bettors.

Caesars identifies sharp bettors as those who make large cash wagers and have historically netted closing line value on those bets.

(You obtain closing line value — CLV — if you place a bet that improves before the start of a game. For instance, if you took the Rams at -3.5 and the line closes at Rams -4.5, then you would have received closing line value because you beat the closing odds by a point.)

A more thorough explainer of the concept, and why it's important, is located here.)

As aforementioned, Caesars considers wagers by sharp bettors — those who pick up CLV on massive stakes — to be the biggest individual factor in determining line movement.

Other books move their lines with different considerations in mind.

At PointsBet, they give the global market more weight, said Mike Korn, a sports analyst at the company. That means if several other sportsbooks make changes to their lines, regardless of PointsBet's liabilities or sharp action, they're more likely to make alterations, too.

That's in order to prevent heavy arbitrage on their books, in addition to ensuring that their betting splits are properly balanced.

Still, like any other book, once liabilities hit a certain threshold, PointsBet's trading desk conducts an analysis to determine whether the line should be subject to a move.

One sharp bettor is less likely to move a line like the Super Bowl at PointsBet. But, PointsBet did follow Caesars to Rams -4.5 on account of Caesars' single sharp bettor. It's a massive chicken-or-the-egg jostle between competitors.

With these factors in mind, there doesn't appear to be enough momentum to shift this line down toward the key number of Rams -3. Or even below Rams -4. Even a substantial shift in public sentiment won't be enough to move this line that low — only the massive moneyed bets of a dozen or so Cincinnati backers will.

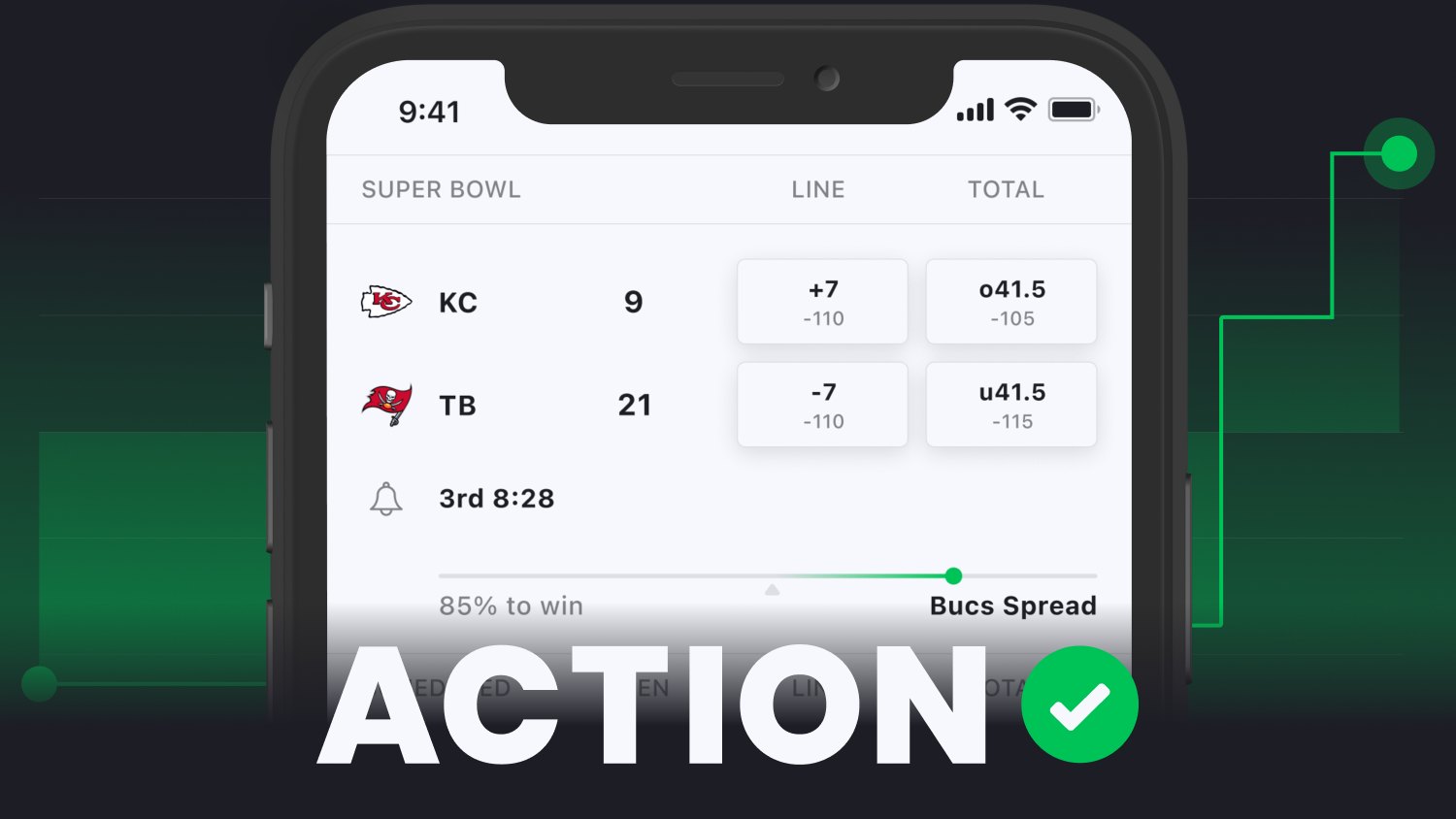

Keep an eye out for heavy sharp and big money action on either side of this line via The Action Network's live tracking data here.