The largest name behind name, image and likeness might need a hail mary.

Five days from facing a potential delisting from the NASDAQ, Miami Hurricanes booster John Ruiz and his company LifeWallet filed a document with the Securities and Exchange Commission six minutes before the close of business on Friday saying that any financial information, including filed earnings releases, investor presentations and other communications put out by the company over the last year "should no longer be relied upon."

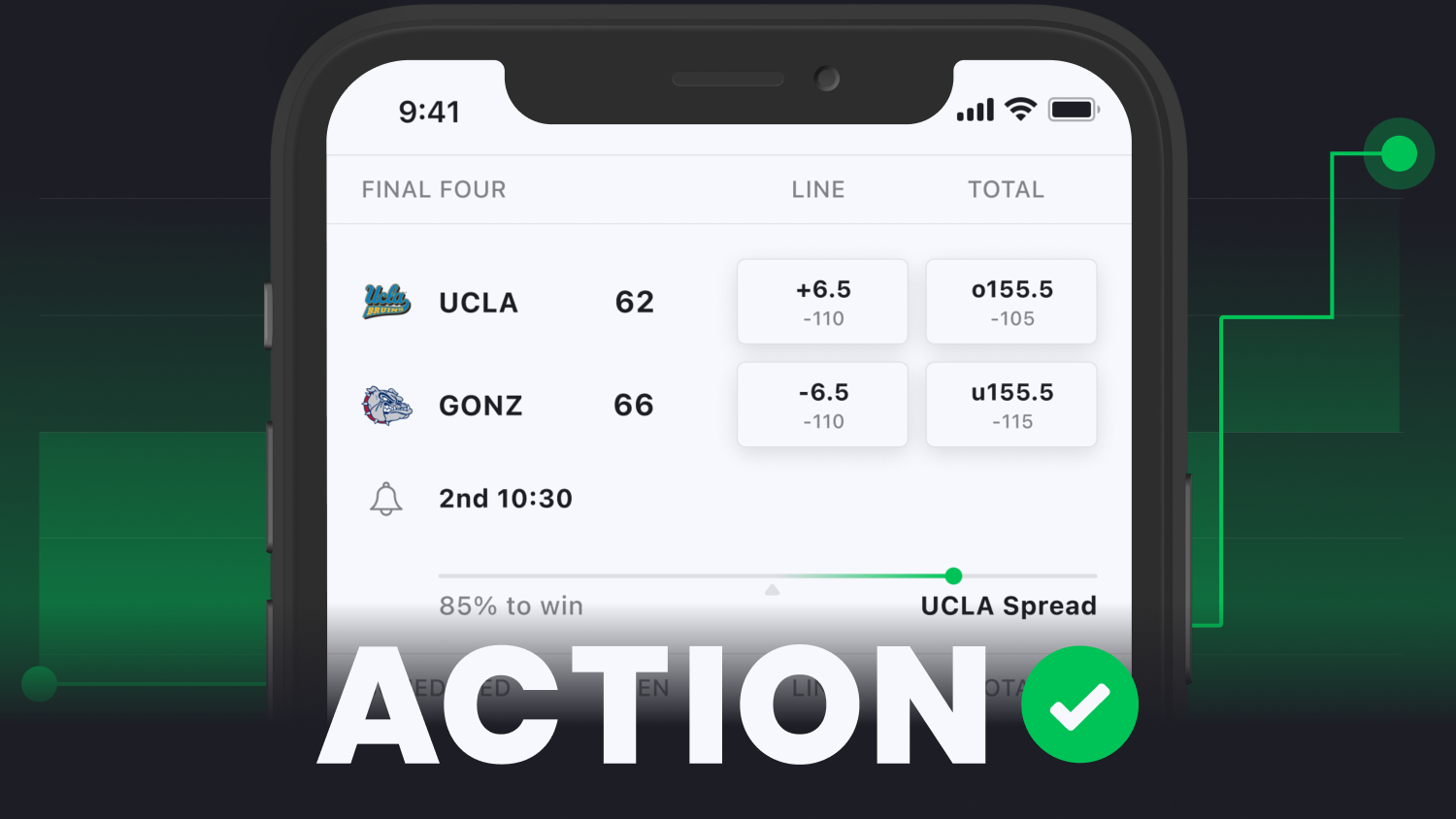

At the behest of Ruiz — its founder — LifeWallet doled out more than $5 million to more than 100 college athletes, mostly to those playing for University of Miami. He awarded NIL deals to at least four players who helped the Hurricanes to a Final Four appearance and to twin influencers Haley and Hanna Cavinder, who shocked No.1 Indiana and made it to the Elite Eight in the women's tournament this season.

A deal that lured Kansas State transfer Nijel Pack to Miami cost Ruiz about $800,000. A deal to incentivize leading scorer Isaiah Wong to stay put ran Ruiz about $100,000.

But on the Friday before the Final Four, LifeWallet reneged on their promises to deliver fourth quarter and yearly earnings, a major red flag in the financial world.

As the prospect of being delisted got closer — 30 days of trading below $1 — shares of LIFW exploded curiously this week on no new information. At its close on Friday, Life Wallet was at 88 cents, up 29.2% on the week.

LifeWallet has two businesses. The main part of its valuation involves suing insurance companies that should have paid for medical bills that Medicare or Medicaid ended up financing. The company told investors it could recover up to $89 billion by doing this.

Ruiz provided guidance that 2022 revenue would approach $1 billion. When the company first reported quarterly earnings, the numbers were paltry. Nine months of revenue yielded just $3.9 million after projecting income of $992 million. Operating losses were $118 million.

Friday's 8-K filing to SEC said those numbers — as with all data the company published from June to Dec. 2022 — have been declared unreliable, with the company adding that it identified "material weaknesses in internal controls related to the accounting for complex transactions."

The value of LifeWallet's total business was said to be $33 billion and on paper would have made Ruiz a billionaire. But lawyers who have spent decades in the medical recovery business skeptically strained their eyes at what the real underlying business entailed.

“John claims he has the algorithms to find good cases and because he’s public now, he is going to be forced to prove that he has something of value,” David Winker, a Florida board certified healthcare lawyer who is representing a plaintiff against Ruiz in a lawsuit, told the Action Network earlier in the month. “If he’s right, it has the potential to be valuable. But Elizabeth Holmes told investors she had a proprietary way to analyze blood and when investors called her on it, she didn’t have anything.”

The second part of the business involves the original LifeWallet brand, which is a digital health wallet that helps emergency and hospital personnel understand more about someone who might be incapacitated.

Even that business isn't free from trouble. Norberto Menendez, the original founder of LifeWallet — whose name and business Ruiz absorbed — has alleged fraud, breach of contract and negligent representation against Ruiz.

Last month, billionaire Barry Sternlicht resigned from a Miami-based healthcare company that was doing business with LifeWallet, previously branded as MSP Recovery.

In a letter describing why he stepped down, he mentioned "poor governance (demonstrated by transactions such as MSP Recovery)."

With the news, it seems inevitable that LifeWallet will trade below $1 for 30 consecutive days, triggering action by the NASDAQ. When that happens next week, the exchange can send a deficiency notice that gives the company six months to regain compliance. If the company doesn't fulfill its requirement to do so, the stock exchange can request a hearing to reassess the company's standing.

Now, several athletes may be in the lurch, too. It's not known how much of the promised money LifeWallet has delivered. Miami's athletic department may also face questions as to whether it did its due diligence on Ruiz. Or whether Ruiz was simply able to sell them a flimsy bag of goods.

A representative for Ruiz was not immediately available for comment on Friday night.

In January, Ruiz said his company would host a "full presentation" for Miami's spring game, which was scheduled to take place today, April 14.

Ruiz announced today that "LifeWallet will have to reveal the stadium and other projects at a different venue."