Illinois' casino market has been on a significant upswing, driven by new venues and strategic expansions.

According to the latest data from the Illinois Gaming Board (IGB), December 2025 saw substantial growth in gaming revenue. We saw this happening earlier this year.

Let's take a closer look at the figures and what they mean for the state's gaming industry.

December 2025 Revenue Highlights

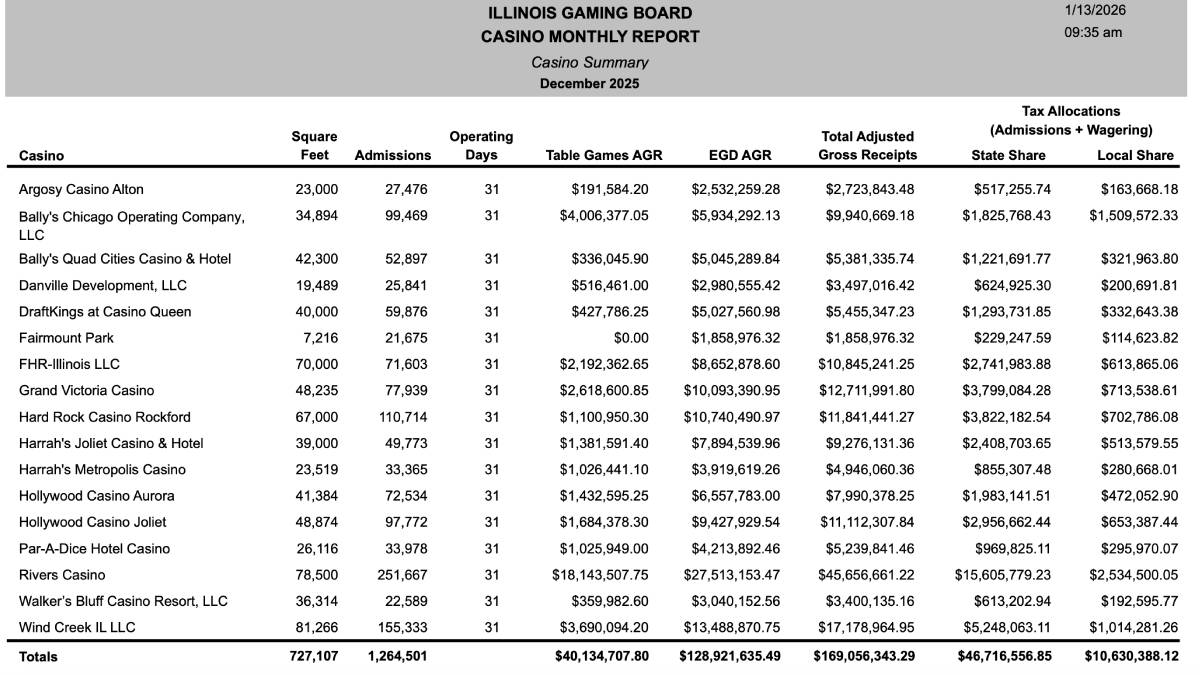

In December, Illinois' 17 casinos recorded a total adjusted gross revenue (AGR) of $169.1 million.

This represents a 7.6% increase from December 2024's $157.1 million, which is hard to ignore.

Wind Creek Chicago Southland led the pack with $17.2 million in revenue, surging by an impressive 53.1% compared to the same month in the previous year.

Since its opening in November 2024, Wind Creek has become a major contributor to Illinois' gaming earnings, primarily thanks to the state's 2019 gaming expansion initiative.

Year-Over-Year Performance: 2025 vs. 2024

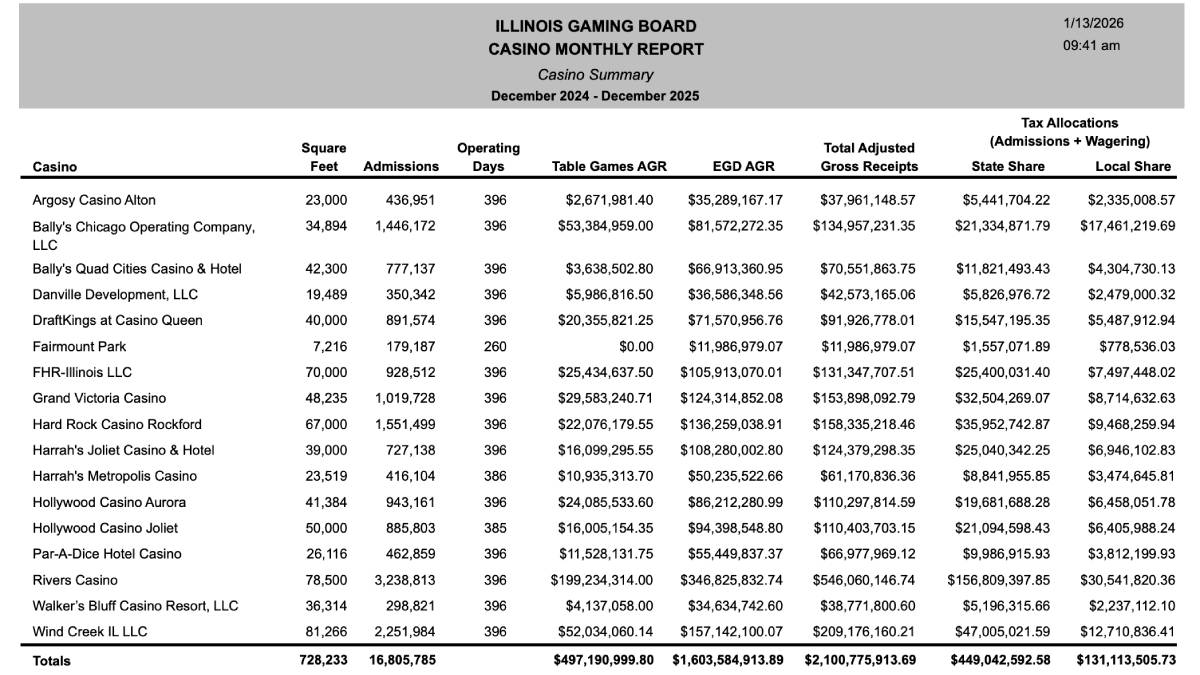

The full year of 2025 proved to be remarkable for Illinois casinos, hitting a record AGR of approximately $1.94 billion, marking a 15% increase over 2024.

This growth was significantly bolstered by newer venues like Wind Creek and Hard Rock Casino Rockford. Wind Creek, for instance, amassed nearly $198 million during its first full year of operation.

Meanwhile, 8 of the 17 casinos reported year-over-year gains, 2 remained stable, while some of the older properties faced slight declines amid rising competition.

The Impact on State and Local Taxes

The booming casino revenue translated into substantial tax contributions.

Illinois casinos collected over $408 million in state taxes and $121 million in local government taxes last year, primarily benefiting the communities that host them. Illinois employs a graduated wagering tax structure that varies by revenue tier and gaming type. Additionally, patrons contribute via an admissions tax, adding $2–$3 per entry depending on the venue.

These tax revenues support various state priorities, including the Education Assistance Fund. Thanks to the flourishing casino market, contributions to the state gaming fund increased to $186 million in FY 2025, up from $158 million in the previous fiscal year.

Future Prospects and Challenges

The sizable growth in Illinois' gaming revenue showcases the positive momentum of the state's expanded casino market.

The entrance of new land-based facilities in the Chicago area has rejuvenated the industry, even as it poses challenges for established venues. As competition intensifies, casinos must find innovative ways to attract patrons and maintain their market share.

All in all, Illinois' gaming industry is thriving, driven by strategic expansions and new market entrants.

The record-breaking revenue figures for 2025 reflect a vibrant and competitive environment that not only boosts local economies but also supports essential state programs through significant tax contributions. As the landscape evolves, stakeholders will be keenly watching how Illinois' gaming revenue continues to shape up in the coming years.