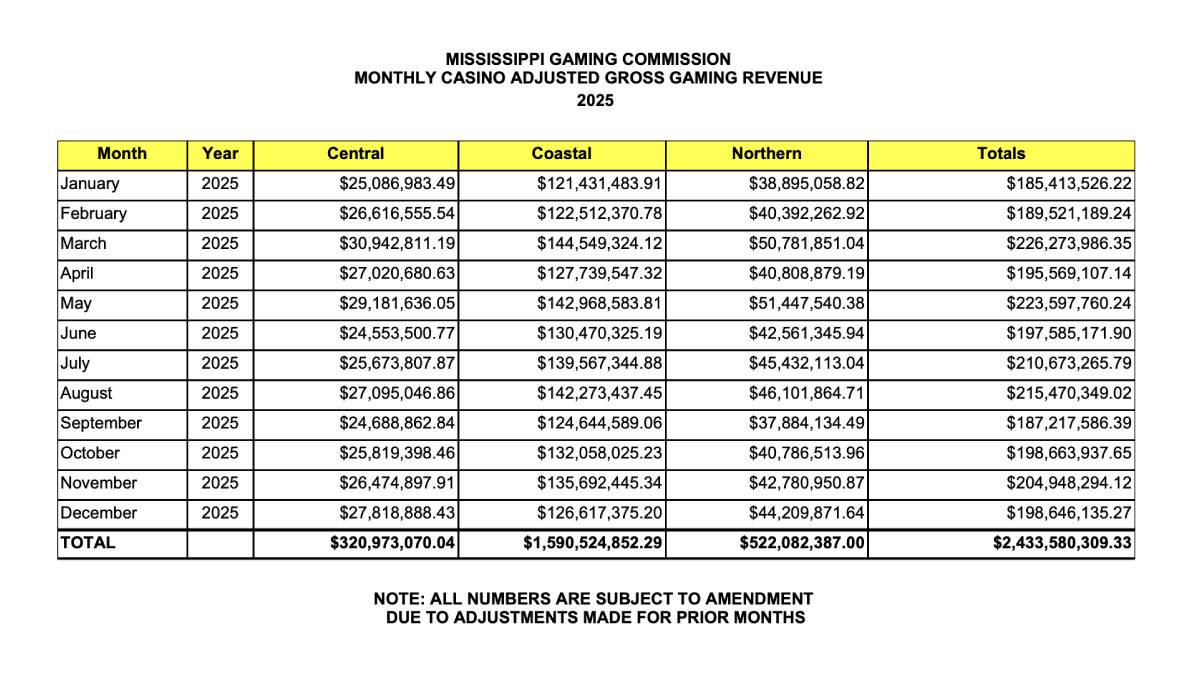

Mississippi's commercial casinos made about $198.6 million in adjusted gross gaming revenue (AGGR) in December.

This turns out to be a slight dip of about 3% compared to November's $204.9 million, according to the Mississippi Gaming Commission (MGC).

While overall numbers showed a decline, the details reveal some interesting regional variations and trends that highlight the changing landscape of Mississippi's gaming industry.

Mississippi Casinos: December vs. November 2025

Comparing December to November 2025, the state's total AGGR dropped by roughly $6.3 million. This marks a 3.1% decrease. However, this isn't the full story. When you look closer at different regions in the state, a more complex picture emerges.

Regional Performance

Central Region: This area outperformed in December, with revenue increasing from $26.47 million in November to $27.82 million. This rise shows some resilience against the statewide decline.

Coastal Region: Here, revenue fell significantly – from $135.69 million in November to $126.62 million in December. This decrease played a major role in the overall drop for the state.

Northern Region: Revenue edged up slightly, from $42.78 million in November to $44.21 million in December. While not a huge increase, it does reflect some growth.

Casinos in Mississippi: Year-over-Year Analysis

Comparing year-over-year, December 2025's revenue of $198.6 million was a bit lower than December 2024's $201 million.

This represents a 1–1.5% decrease. Looking at the entire year, the AGGR for 2025 was about $2.43 billion. Unfortunately, this continues a downtrend from $2.57 billion in 2022 and $2.48 billion in 2023.

Despite national growth in the gaming market, Mississippi's brick-and-mortar casino revenue has been slowly declining.

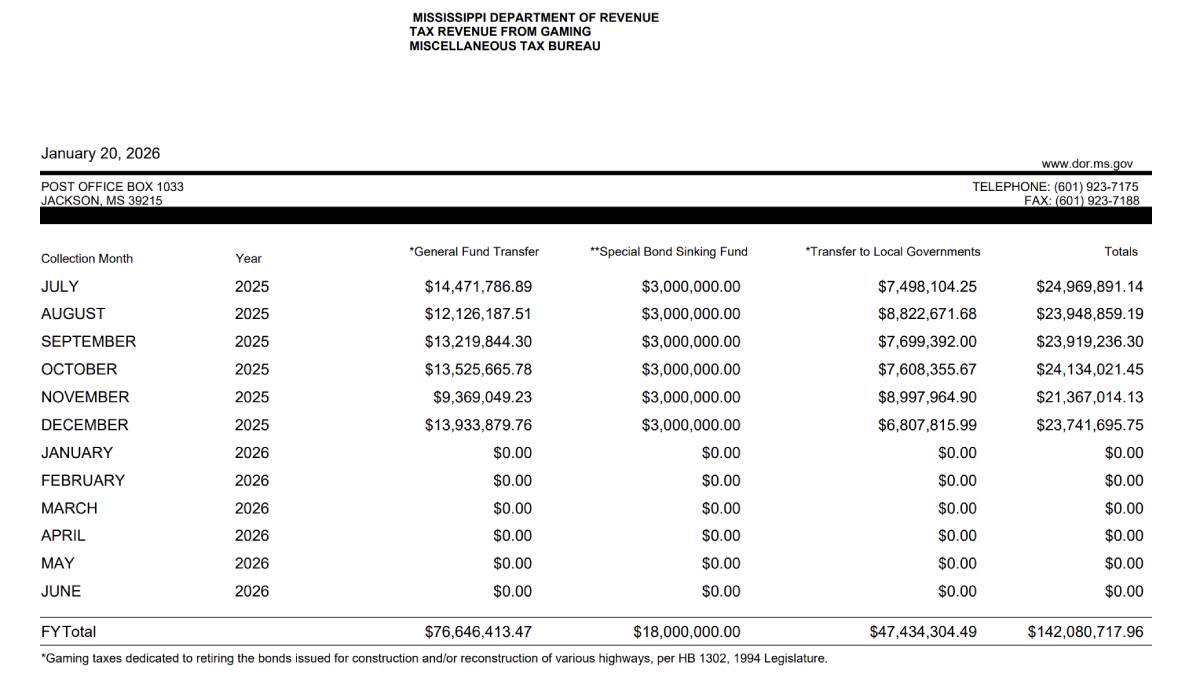

Impact on State Taxes

Mississippi imposes an 8% tax on casino revenues above a certain amount, which helps fund state and local projects, especially in education and infrastructure. The December revenues meant about $15.9 million in state gaming taxes, down from November's estimated $16.4 million.

Examining regional contributions, the Coastal region still provided the largest share of taxes despite its month-over-month revenue drop. Here's how it breaks down:

Coastal Region: Contributed around $10.1 million in taxes. Even with a 6.7% decline in revenue, this area continues to play a crucial role in the state's economy.

Northern Region: Added about $3.5 million in taxes, reflecting its slight revenue growth.

Central Region: Provided approximately $2.2 million in taxes, underscoring its relative stability in December.

Mississippi's casino landscape is clearly changing. For one thing, we'll be watching to see if the state takes up the fight against sweepstakes casinos. Efforts last year failed.

While some regions showed resilience, the overall trend points to a gradual decline in revenue.

This trend means careful planning is needed to sustain the state's investments in local infrastructure and education, especially as casino revenues soften. As Mississippi grapples with this, keeping an eye on regional performances and adapting strategies will be key to maintaining economic health.