December saw a mixed performance among New York's upstate commercial casinos, reflecting varied local market dynamics.

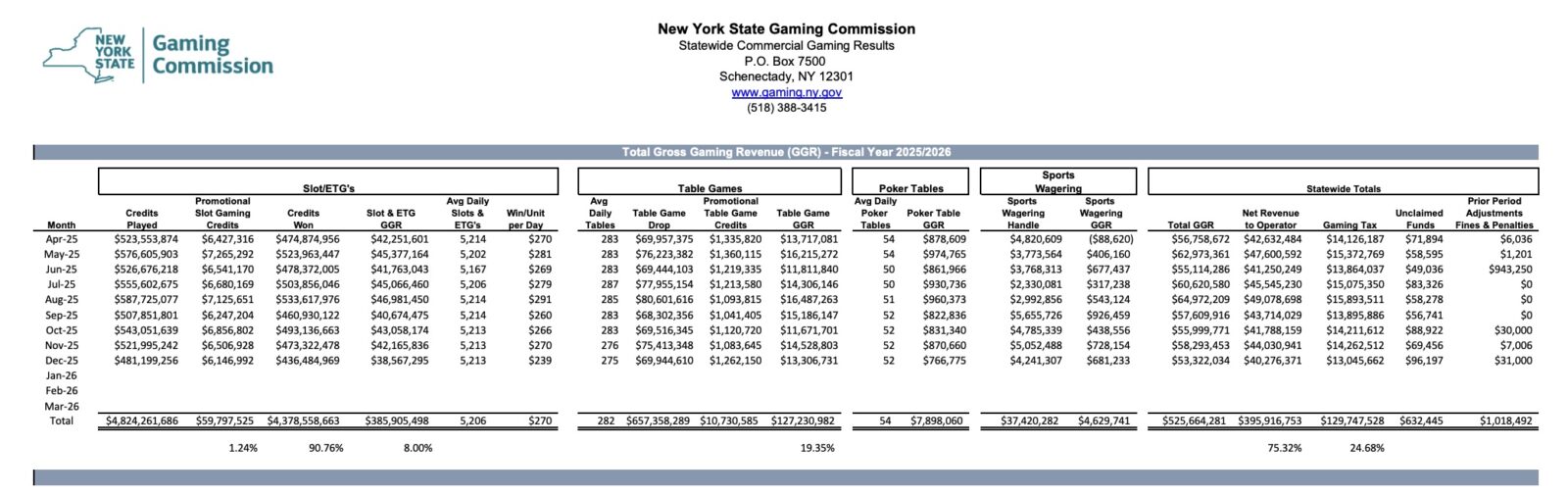

According to the most recent figures from the New York State Gaming Commission, while the overall gross gaming revenue (GGR) fell by 3% compared to December 2024, not all casinos experienced declines. Let's delve into the detailed breakdown provided by the New York State Gaming Commission's monthly report.

The total GGR for New York's upstate casinos in December was $53.3 million, marking a decrease from the previous year's $54.9 million. This dip in revenue highlights challenges faced by the casino industry in the region, largely driven by external factors like increased competition from online gaming platforms.

Ironically, the year ended on a bit of a downer, despite a strong showing over the summer.

Slot and Table Games: Diverging Paths

Slot and electronic table games brought in $38.6 million, a slight 1.6% dip from December 2024.

However, the biggest hit was seen in table games revenue, which plummeted by 11.6% to $13.3 million. This decline is likely due to shifts in player preferences toward slots or other forms of entertainment, as well as the influence of competitive pressures.

Individual Casino Performance in New York

The last month of 2025 also brought a varied set of outcomes for New York's upstate commercial casinos.

Each faced unique challenges and opportunities, painting a complex picture of the gaming industry in this region. While some casinos capitalized on local advantages and strategic initiatives, others struggled with competitive and seasonal pressures.

Here’s how each casino fared during the month.

Rivers Casino & Resort Schenectady

Among the four casinos, Rivers Casino & Resort Schenectady emerged as a strong performer.

It defied the downward trend with a 17.1% revenue increase, totaling $19.4 million. Both slots and table games contributed to this growth, with table games experiencing an impressive 43.7% surge.

Strategic promotions, holiday events, and possibly a robust local market could account for Rivers Casino's outstanding results. Resorts World Catskills: Facing a Significant Decline

Resorts World Catskills

In contrast, Resorts World Catskills endured the most substantial revenue drop of 22%, ending the month at $13.3 million. The casino, situated in a popular tourism area, might have suffered due to seasonal slowdowns, adverse weather conditions, or intensified competition from neighboring ventures.

Del Lago Resort and Casino: Steady but Subdued

Del Lago Resort and Casino, located in Waterloo, experienced a modest 1.6% decrease in revenue, collecting $12.5 million. This suggests a relatively stable local patronage, though without notable gains to boost its performance significantly.

Tioga Downs Casino: Pressures from Across the Border

Tioga Downs Casino, near the Pennsylvania border, saw its revenue shrink by 5.8% to $8.1 million. Its proximity to the state line might expose it to competition from Pennsylvania-based facilities, aligning it with broader regional challenges.

Growing Sports Betting Market and Casino Expansion in Downstate Area Pose Threats

This revenue fluctuation comes amid broader developments in New York's gaming landscape.

In December, the Gaming Commission authorized three new commercial casinos for the downstate/New York City area. These facilities are projected to contribute significantly to the state's gaming revenue in future years.

Compounding pressures on traditional casinos is the booming mobile sports betting sector in New York, which amassed around $260 million in GGR for December 2025. This reflects a growing trend where online platforms are drawing more player engagement than retail locations.

In the end, New York's casino figures from December underscore a shifting gaming environment in upstate New York.

While Rivers Casino & Resort Schenectady shines in this mixed landscape, other casinos face headwinds from economic pressures and increasing digital competition. For those interested in a more detailed look, the complete financial breakdown is available in the New York Gaming Commission's monthly report.