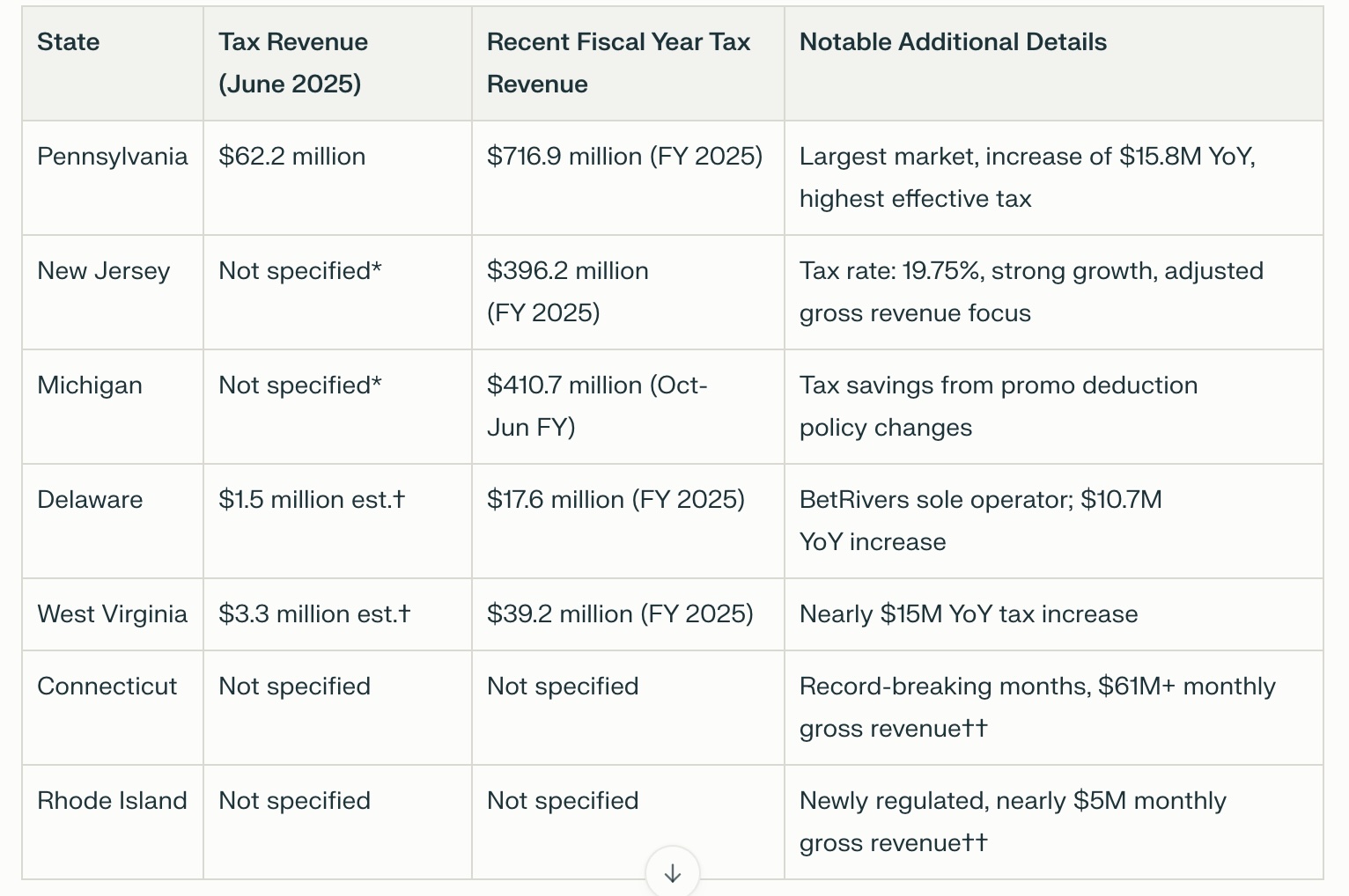

The seven regulated iCasino (online casino) states in the U.S. collectively generated $161.6 million in tax revenue from online casino activity in June.

These states include Pennsylvania, New Jersey, Michigan, Connecticut, Delaware, West Virginia, and Rhode Island—the seven U.S. jurisdictions with fully regulated iCasino markets.

Platforms across the seven states generated over $830 million in online casino revenue. Many of these states also reported strong year-over-year growth as they concluded their fiscal calendar years.

This all adds up to operator gross winnings increasing more than 31% year-over-year from June 2024, and tax collections jumped by nearly $41 million compared to June 2024.

Pennsylvania Online Casinos Continue to Lead the Pack

Pennsylvania led the group with $262.5 million in online casino revenue for June and contributed the largest tax share at $62.2 million, which was $15.8 million higher than the previous year. Both are also records for the regulated iCasino market.

The numbers were undoubtedly helped when the Keystone State became the sixth to join the Multi-State Internet Gaming Agreement (MSIGA). It started a new era of online gambling in Pennsylvania.

New Jersey and Michigan both surpassed $230 million in revenue, with New Jersey’s adjusted gross revenue at $2.64 billion for its fiscal year and $396 million in associated tax revenue by June.

Michigan recorded $2.16 billion in gross revenue (October–June fiscal period), and nearly $411 million in tax revenue for that span. The Wolverine State saw a record year in 2024, and now it's trying to surpass it.

Bally’s in Rhode Island finished its first full fiscal year on a high note, with revenue in June 2024 more than doubling to nearly $5 million and customer spending (or "drop") increasing by roughly 99% to $123 million. However, the $22 million collected in tax receipts fell short of the state's November 2023 projection of $28 million.

Bally’s set a goal of $40 million in tax revenue for fiscal year 2026.

What is Driving the Year-Over-Year Growth?

Several growth drivers are getting the credit, including:

- Increased online engagement

- Successful promotional offers

- Cross-over play with online sports betting

All seven states saw notable growth, with Pennsylvania, New Jersey, and Michigan serving as the largest markets by both revenue and tax collection.

Smaller states such as Delaware and West Virginia also reported significant gains, with Delaware’s tax revenue rising $10.7 million year-over-year and West Virginia seeing nearly $15 million more in tax receipts than the previous year.

This collective $161.6 million monthly tax intake reflects the ongoing expansion and fiscal significance of regulated U.S. iCasino markets, all of which experienced robust annual growth in both revenue and taxes for June 2025.