December proved to be an intriguing, albeit challenging, month for Detroit casinos, as revenues continued to reflect broader industry shifts.

Detroit's three commercial casinos—MGM Grand Detroit, MotorCity Casino, and Hollywood Casino at Greektown—reported a combined monthly aggregate revenue of $105.1 million last month.

That total includes $103.4 million from table games and slots, with retail sports betting contributing $1.7 million.

Compared to December 2024, this represents a 5.4% decrease in table games and slots revenue, and a 2.9% decline from November's $108.2 million. This downturn highlights the pressures traditional casinos face in an increasingly competitive market.

Market shares among the three casinos for December were as follows:

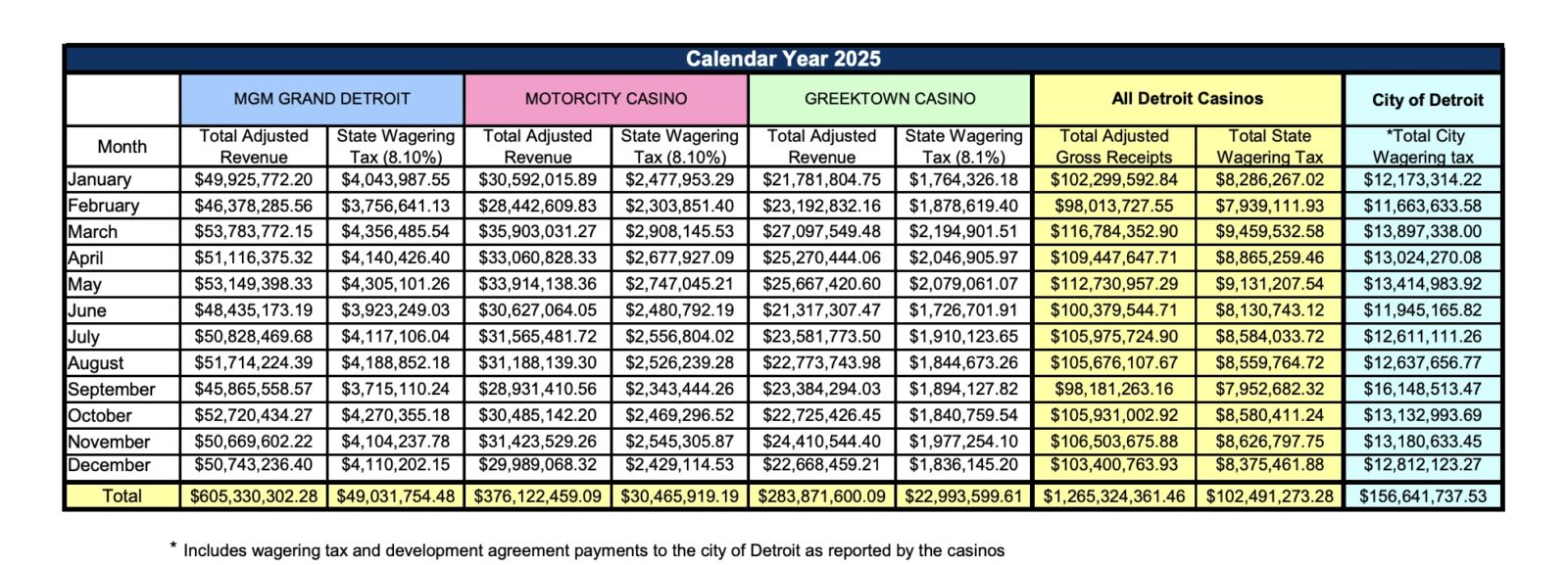

- MGM Grand Detroit held a 49% share ($50.7 million, down 1.0% year-over-year)

- MotorCity Casino claimed 29% ($30.0 million, down 9.2%)

- Hollywood Casino at Greektown came in with 22% ($22.7 million, down 9.5%)

The December numbers are somewhat similar to what we saw in September.

Retail Sports Betting Has Positive Month

Retail sports betting, though a small part of overall revenues, showed some positive signs.

Qualified adjusted gross receipts for sports betting improved compared to December 2024. This slight uptick may be attributed to heightened interest during the holiday season and major sporting events driving foot traffic to these casinos.

For the full year of 2025, Detroit’s casinos generated total aggregate revenue of $1.28 billion, slightly down from $1.29 billion in 2024.

Slots remained the primary revenue driver at $1.02 billion (79.5%), while table games generated $247.8 million (19.4%). Retail sports betting brought in $14.2 million, marking a notable 45.9% increase year over year.

Growing Trends in Online Gaming

While land-based casinos saw declines, Michigan’s online gaming sector—particularly iGaming (online casinos and poker)—significantly outpaced the traditional casino market in 2025.

Online platforms set multiple records, with gross iGaming receipts reaching $278.5 million in October 2025, a 26.2% increase year over year. Hard Rock Bet also launched in The Wolverine State last month.

Throughout the year, iGaming generated $2.52 billion in gross revenue, surpassing expectations and continuing to climb, potentially reaching or exceeding $3 billion by year’s end. This trend shows a clear preference for the convenience and accessibility offered by online gaming.

The Broader Context

The contrast between growth in iGaming and the downturn in land-based casino revenue suggests a shift in consumer preferences. Detroit’s casinos, while still important economic players, are now sharing the spotlight with online platforms. In fact, Michigan’s online sectors are setting state and national benchmarks, often achieving all-time highs.

As Michigan’s online gaming market continues to thrive, land-based casinos may need to revamp their strategies. Enhanced customer experiences and targeted promotions could help attract visitors, but the digital trend appears poised to dominate the gaming landscape in the coming years.

Detroit’s casinos find themselves at a crossroads, facing challenges from booming online gaming sectors while trying to maintain their traditional appeal.

December 2025 reflected these dynamics, with Detroit’s casinos seeing revenue declines compared to previous periods, in contrast to the substantial growth in online gaming. As consumer preferences continue to evolve, Detroit’s casinos will need to adapt to sustain their presence in Michigan’s vibrant gaming industry.