Casinos continue to kill it in the Keystone State.

The Pennsylvania Gaming Control Board (PGCB) recently released its gaming revenue report for December, revealing an impressive $616.72 million in total revenue.

This marks a significant 15.76% increase from December 2024, underscoring the robust growth of Pennsylvania’s gaming industry, particularly in online channels.

The key driver behind this remarkable leap? The surging success of Pennsylvania online casinos and sports wagering. What’s even more striking is that Pennsylvania’s online casino market is already a major player in the industry—and it’s expected to get even stronger next year.

A Year of Records in The Keystone State

December wasn’t just an ordinary month for Pennsylvania’s gaming sector—but we probably should have seen it coming as early as October.

It stood as one of the highest-grossing months in the state’s history, emphasizing the growing shift toward digital gaming platforms. These trends aren’t isolated incidents; they’re part of a larger story in which online gaming is increasingly overshadowing traditional retail operations.

For the entirety of 2025, Pennsylvania’s gaming revenue likely surpassed an impressive $6.3–$6.4 billion, solidifying its place as the second-largest gaming market in the United States, flanked by Nevada and New Jersey.

Retail Casinos: A Mixed Bag

While retail casinos remain integral to Pennsylvania’s economic landscape, their performance was mixed.

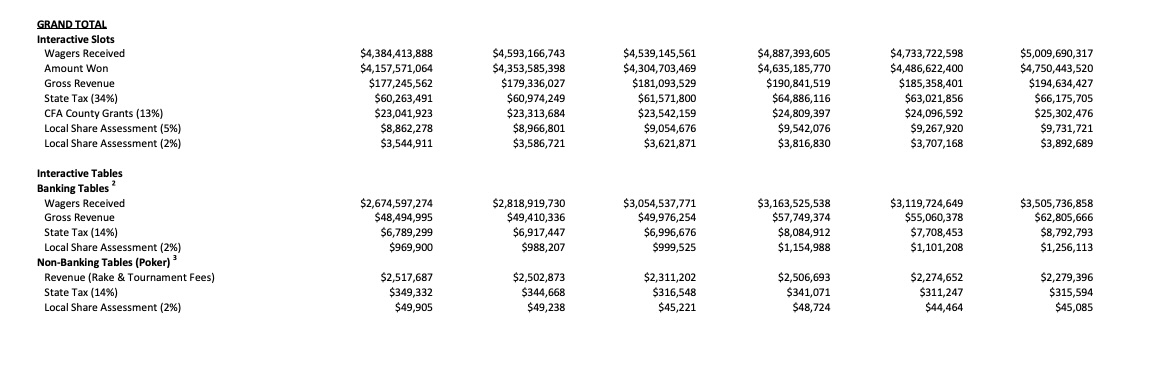

- Slot machine revenue dipped by 7.54% to $186.83 million, suggesting a plateau in traditional gaming formats.

- Table games managed a slight uptick of 0.28%, bringing in $79.28 million.

These figures highlight a gradual post-pandemic stabilization, though the retail sector continues to experience a shift toward more digitally inclined play.

Pennsylvania Online Casinos: The Crown Jewel

Online casinos—encompassing online slots and table games—spearheaded Pennsylvania's gaming growth, shattering records with a total revenue of approximately $324.3 million in December alone.

- Online slots surged by 18.49% to $194.63 million.

- Online table games grew by 10.34% to $62.81 million.

- For 2025 as a whole, iGaming sales reached about $3.46 billion, a staggering 27.7% year-over-year increase.

This burgeoning segment illustrates a clear preference among players for the convenience and variety offered by Pennsylvania online casinos, propelling the state’s market ahead of others, including New Jersey.

Sports Wagering: A Winning Bet

The sports wagering landscape also experienced monumental growth.

Despite an 11% drop in handle to around $798 million, revenue soared by 287.82% to $84.81 million. This significant jump in revenue, despite lower betting volume, points to operators achieving stronger returns per dollar—possibly influenced by favorable outcomes during key sporting events like the NFL and college bowl games.

Retail Giants and Online Alliances

Within the casino arena, Valley Forge Casino Resort and Hollywood Casino at Penn National emerged as leading lights.

Valley Forge garnered $121.8 million, thanks largely to its strong partnership with FanDuel, a leading iGaming and sportsbook platform.

Hollywood Casino, with revenue of $116.5 million, benefited from its affiliations with major online brands like DraftKings and BetMGM. These collaborations between retail casinos and online platforms illustrate the synergistic potential driving Pennsylvania’s gaming success.

Implications and Future Outlook

The dominance of online gaming in Pennsylvania’s market is undeniable. Digital platforms now contribute over 65% of the state’s monthly gaming revenue, a factor that not only signals transformative change for the industry but also underscores its fiscal significance. In December alone, nearly $256 million was generated in state taxes, highlighting the sector’s contribution to Pennsylvania’s economy.

Looking ahead to 2026, the trend appears poised to continue.

Should current patterns hold, iGaming revenues may well exceed $4 billion annually. However, as player engagement increasingly shifts online, retail casinos may need to innovate and adapt to remain competitive.

All in all, Pennsylvania online casinos and the broader iGaming sector have not only sustained the state’s position in the gaming hierarchy but have also paved a path for continued economic prosperity.

As we move further into 2026, the emphasis on digital growth and strategic partnerships between physical and online operators will likely define the state’s gaming frontier.