DraftKings announced Monday that it would merge with sports gambling tech firm SBTech and go public.

The transaction was facilitated by Diamond Eagle, a publicly traded acquisition company on the Nasdaq that will change its name to DraftKings and trade under a DraftKings symbol.

Once the transaction closes, which the parties expect to happen in the first half of next year, the company will result in the first pure online betting play available for the public to buy interest in.

Upon closing, investors, including funds managed by Capital Research and Management, Wellington Management and Franklin Templeton, will invest $304 million in common stock. The combined company will be valued at $3.3 billion.

“The combination of DraftKings’ leading and trusted brand, deep focus on customer experience and data science expertise and SBTech’s highly innovative and proven technology platform creates a vertically-integrated powerhouse,” said Jason Robins co-founder and CEO of DraftKings. “I look forward to building significantly upon our goals of continuing our state-by-state rollout and creating the most entertaining and engaging customer experiences for sports fans globally.”

Both DraftKings and SB Tech management teams will remain in place as part of the deal.

On Aug. 1, 2018, DraftKings, known previously as a daily fantasy company, started to reinvent itself as a sports gambling company. It was the first to launch a mobile option in New Jersey, which has become the second largest sports gambling state in the nation. Today it owns more than 30% online market share in the state, only topped by its daily fantasy competitor FanDuel.

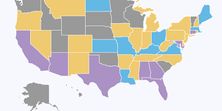

DraftKings is currently mobile in four states (New Jersey, Pennsylvania, Indiana and West Virginia), and it will launch in New Hampshire by the end of the year. The company also has retail operations in four states (New Jersey, New York, Mississippi and Iowa)

SB Tech is a white label tech platform that provides odds-making services to brands. DraftKings has used SB Tech's competitor, Kambi, thus far, but the acquisition will bring SB Tech in house.

It was assumed that perhaps SB Tech would become exclusive to DraftKings, but initial details don’t appear to make that the case. In the news release, SB Tech chairman Gavin Isaacs said “SBTech will maintain its core business and continue its B2B focus."