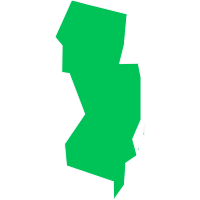

Thursday marked the first close of Fanatics' $225 million acquisition of PointsBet as the sports merchandising company gains sportsbook access in eight states (Colorado, Iowa, Kansas, Maryland, New Jersey, Pennsylvania, Virginia, and West Virginia).

PointsBet customers will now see the business in these states being rebranded to PointsBet, a Fanatics Experience. Illinois, Indiana, Louisiana, Michigan, New York and Ohio will eventually close and be rebranded similarly.

Fanatics will pay $175 million for the eight states that launched today and an additional $50 million for the subsequent states.

It has been a long road for Fanatics, substantively getting into the game more than five years after gambling in America has been legalized.

It comes more than two years after Fanatics hired FanDuel CEO Matt King to run their business. In the meantime, Fanatics has built their own tech stack and acquired PointsBet, which owned Banach, a best-in-class trading platform that specializes in offering smart live betting algorithms.

To address Fanatics' state of affairs heading into the new NFL season — the most important time for American sportsbooks — the Action Network spoke to Fanatics' Betting CEO.

Darren Rovell: Well, you are finally here. Let’s get to the essential question. How do you ultimately win, being so far behind?

Matt King: You have to have a long term perspective, not a two-year vision, but a ten- and twenty-year vision. The market is still very early in this digital industry. I believe there’s too much focus on the first mover. If you look at a 20-year horizon it’s not how you get out of the gate. If you look at search industry’s first movers, no one saw Google coming.

Rovell: That’s fair. And yet your former company FanDuel and DraftKings have built massive leads in an industry where the average bettor downloads fewer than two apps. What do you say to critics that say sports betting apps and lines are not substantively differentiable enough?

King: I say sports bettors haven’t experienced what it’s like to be in a true ecosystem like Fanatics. If you look at satisfaction rankings for sports bettors, the app loyalty scores much lower than other apps. Expectations from sports bettors are lower. We’re gonna challenge that model. We have a mix of people who has spent 20+ years in the sports betting industry with executives in other sectors that disrupt the thinking in this industry, combining a great consumer tech experience with deep sports betting experience.

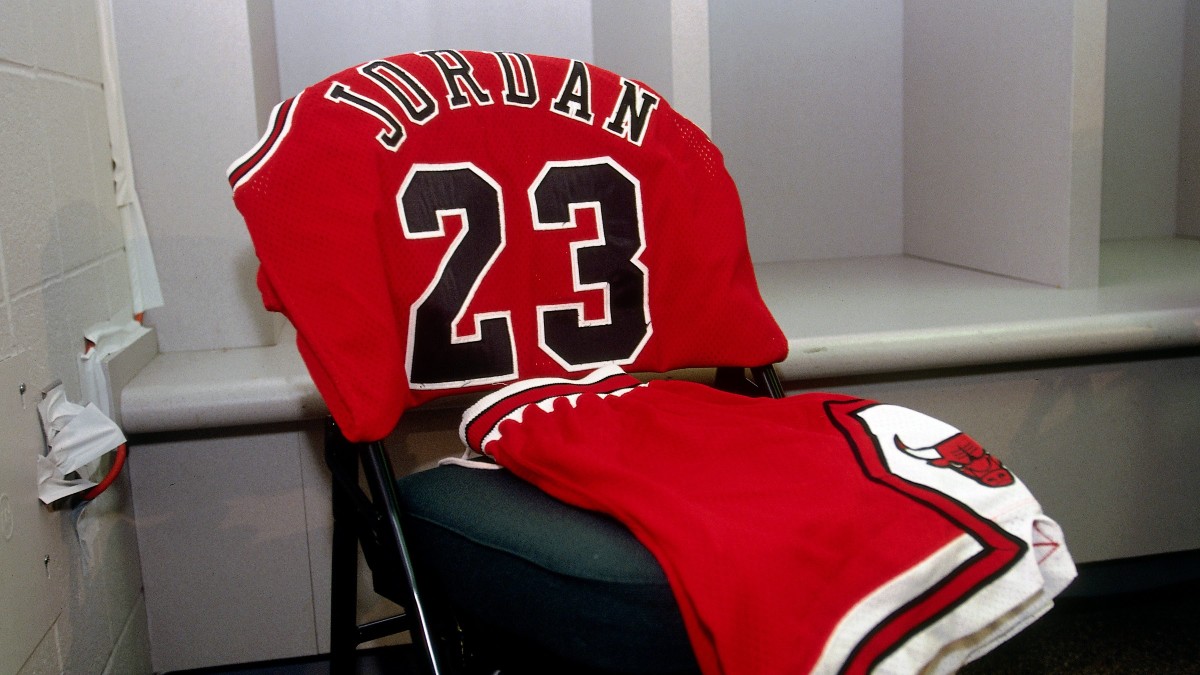

Rovell: To be honest, loyalty programs, for the most part, have been none existent to not strong in the sports betting space. You guys are hoping to change that. Today, for example, Fanatics is instituting a Jersey Drop Promotion, where any fan who opts in and places a single wager of $50 or more receives a credit of up to $150 to purchase a jersey. You offer five percent cash back on same game parlay bets. How strongly do you feel doing things like this will do the trick?

King: We are focused on easing the pain points like having the easiest sign up, the easiest way to deposit money and the best version of live betting, but being able to earn our FanCash, our loyalty currency, is really important. We recognize that being a sports fan is hard. People spend so much money on merchandise and tickets and other things. So we have a huge opportunity to create an emotional connection because our businesses are at the nexus of sport and we can tap into that and whether it’s gear or collectibles, the subset of what bettors can get will continue to grow.

Rovell: Critics, and to be fair it includes your competitors, say Fanatics overplays the database it has. Who in their database isn't a bettor already?

King: I think the argument of the actual names in the database misses the point. It’s really about creating a cost advantage. We can get to sports fans cheaper than everyone else versus what they spend. Our competitors are offering free bets of $300 to $400 to hook bettors and frankly many take those free bets and don’t stay.

Rovell: I want to dive a bit deeper there. So you can approach people in your database, but the idea is also to create momentum in the moment when someone purchases something from Fanatics. In May, you guys had a promotion in Ohio whereby anyone who purchased something on Fanatics got the equivalent of up to $500 in free bets. There was concern from Ohio regulators that such an offer w could be seen by kids and there wasn’t enough fencing around that.

King: We’ve got an exceptional team and we are going to push the limits on trying things others haven’t because we have a set of assets they don’t. We plan to obviously stay within the boundaries of what the regulators set up for us, but we are going to be creative.

Rovell: PointsBet’s strength was its back-end systems because of needing to price right from a risk perspective on PointsBetting. Then came the Banach acquisition, and I felt that PointsBet was best in class on live betting, which is obviously growing in the U.S. I feel like in the last year, others have gotten better in the space on live betting, but it’s still clunky where bettors make a bet, click a button, odds then change and the bet locks in.

King: Live betting right now is too much like the airlines. There’s nothing worse than picking a flight and then the prices move. We, as an industry, have to look at how do we properly balance line prices and still make it a good consumer experience. It’s way too much like airlines now.